What is depreciation? Starting off with the basics

Since the majority of a company's assets such as furniture, machines, or buildings lose value over the course of their useful life, they can only be used for a limited time. Other intangible assets such as software, licenses, patents, or blueprints, and various current assets such as partially or fully finished goods or even company shares, may also suffer from market price decreases in the form of value diminishments as they become obsolete. To trace such losses in balance sheets, they must always be recorded by the company’s accounting department. All this is nowadays known as depreciation.

Depreciation is an indispensable part of accounting and tax law. However, the term often causes confusion among young entrepreneurs, who struggle not only to find the difference between straight-line and reducing balance methods of depreciation, but also have difficulties in differentiating between assets which can and cannot be written off. Find the answers to these and many other question below.

What does depreciation mean? Defining the concept

The wear and tear of computers, office furniture, machines, cars, or even buildings in your everyday business activities is a natural process causing various decreases in value, which must be subsequently recorded in your accounts as depreciation. Such wear and tear is of great importance both in a commercial and fiscal sense.

Recording depreciation for commercial purposes is a matter of presenting company assets and their corresponding value diminishments in a correct manner by means of balance sheets and other similar financial statements. On the other hand, tax depreciation offers the possibility of reducing the amount of taxable income reported by a business. However, these two processes are not always connected.

Planned and unplanned depreciation

In principle, depreciation can either be planned and unplanned. The former, time-based method, is the result of scheduled, regular value diminishments, whereby the total value of an asset is divided by the estimated number of years of its useful life and depreciated in accordance with this calculation method. If an asset’s useful life is undeterminable (which is often the case with various licenses or other similar intangible acquisitions), it is generally scheduled for ten years.

Depreciation of company assets can be caused by factors such as:

- Natural wear and tear

- Expiry of rights or licenses

- External forces (meteorological, for instance)

- Technical progress

It is not only this scheduled depreciation calculation method, but also various unplanned depreciation types which pertain to current assets. If a machine endures unexpected, unrepairable damage or suffers a loss in its market value caused by changes in stock market shares, you can subtract respective depreciable amounts from the asset’s total value during any given financial year.

Which assets can be depreciated?

In principle, every loss in an asset’s value must be taken into account. It is, however, primarily a question of depreciation caused by wear and tear, or in other words, the natural deterioration of objects with a limited useful life, the purchase or production costs of which can be fully written off during this period. Tangibles such as office machinery, Persian carpets, or even entire factory sites and intangibles such as licenses, computer programs, or rights show just how wide the range of depreciable assets actually is.

Depreciation methods

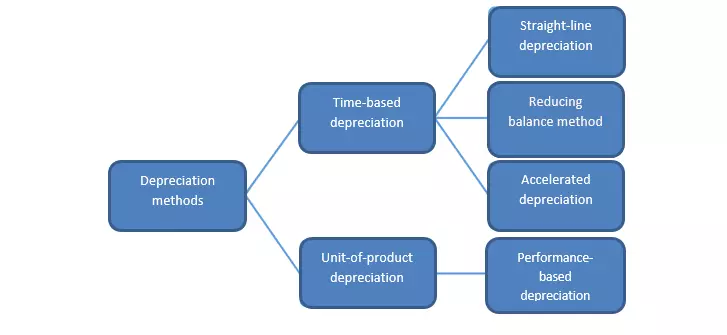

As we have already mentioned in this article, depreciation can either be planned or unplanned. However, planned depreciation entails further methods, which assign different calculation techniques to write off the value of assets. The amount you write off depends solely on the chosen method. Below are the most fundamental methods.

Time- and performance-based depreciation

Since each financial year must generally include depreciations on assets with limited useful life, the annual calculation of depreciation is the most common when assessing value diminishments of company assets.

In some cases, however, so-called unit-of-production depreciation is also a possible calculation technique. In this depreciation method, the asset’s value diminishment is calculated on the basis of its exploitation. A typical example of this is a truck, the value of which is assessed according to its mileage. This calculation method is therefore not based on the asset’s period of use, but rather on its overall performance (just like the truck has been assessed according to the distance it covered).

Straight-line depreciation

Straight-line depreciation is the most common of all time-based depreciation methods. Here, the asset’s carrying value is evenly spread over its entire useful life. What this assumes is that the asset is exploited at the same rate during each of its useful life years.

In other words, the depreciable amount remains the same for each year of the asset’s useful life apart from the acquisition year, during which the asset’s value diminishment is assessed on the basis of the month in which it was obtained (for instance, if the asset was purchased in April, then the first three months are not taken into consideration when calculating the depreciation value).

Reducing balance method of depreciation and accelerated depreciation

As the term “accelerated depreciation” may already suggest, when using this calculation technique, the annual depreciation amounts increase during each of the asset’s useful life years. However, this depreciation method is rarely used, as it is traditionally only suited for facilities, which generate greater income year after year (wineries).

The reducing balance method of depreciation is closely related to this. In this method, the amounts that you subtract from the asset’s value are continuously reduced over the course of its useful life. Annual depreciation values therefore start at a higher level and then gradually decrease. This method, primarily aiming to promote investment, was temporarily approved for this very purpose during the global financial crisis of 2008.

The reducing balance method of depreciation, which sets a fixed depreciation rate (20%, for instance) on the respective book value, follows a geometric depreciation sequence in the process of calculation. In addition to this, there is also an arithmetic depreciation sequence, in which the book value, as its name suggests, is determined using a declining numerical sequence.

Depreciation rates – capital allowances

In order to correctly calculate all depreciation-related values, you must remember that HMRC (Her Majesty’s Revenue&Customs department) does not take into account any depreciation costs, but rather sets out its own version of depreciation called ‘capital allowances’. These are amounts that a business spends on assets which can be later subtracted from what that business owes in tax.

The two most commonly used types of capital allowances are the Annual Investment Allowance and Writing Down Allowance. The former allows to deduct the full value of assets used solely for business purposes (with a maximum AIA amount of £200,000). The latter, however, enables to deduct a percentage of the value of an item from the profits each year. The percentages depend on three rate pools: main pool with a rate of 18%, special pool with a rate of 8% and a single asset pool with a rate of 18% or 8% depending on the item.

Main pool rate

For the main pool, add the value of all plant and machinery, i.e. items that you keep to use in your business except things that you lease, land and structures such as bridges or roads. Apply the rate of 18% on the total sum.

Special pool rate

A lower rate of 8% is applied to integral features of buildings (lifts, space, and water heating systems, air-conditioning, electrical system etc.), long-life items (with a useful life of at least 25 years from when they were new), thermal insulation on buildings and cars with CO2 emissions of more than 130g/km.

Long-life items are put in the special pool if their total purchase value during single accounting period (the tax year if you’re a sole trader or partner) adds up to £100,000. However, you must put them in the main rate pool if their total value is less than £100,000.

If your accounting period does not consist of the full 12 months, adjust the amount according to the amount of months which apply to an item. For example, your limit will be £75,000 if your accounting period is only 9 months (9/12 x £100,000 = £75,000).

Single asset pool rate

Single asset pools are created only if assets have a short life or are used outside your business if you’re a sole trader or a partner. It is up to you to decide whether something is going to be treated as a short-life asset or not. However, you can’t include the likes of cars or special rate items. Large numbers of very similar items can be pooled together and the pool ends as soon as you sell the asset, meaning that capital allowances can be claimed over a shorter period.

If you’re still using the asset after 8 years, move the balance into the main pool in the next accounting period. As well as that, you must let HMRC know on your tax returns and on your decision to create a short life asset pool within 2 years of the end of the tax year.

Summary: what does depreciation mean?

- What is a depreciation? Depreciation records the loss of value of individual assets, i.e. the amount by which individual assets have been reduced

- The current tax depreciation system in the United Kingdom is regulated by HMRC (Her Majesty’s Revenue and Customs)

- There are two basic depreciation types: planned and unplanned depreciation

- The most common depreciation methods are time- and performance-based

- 3 different differentiation rates apply to company assets and their percentage varies according to the type of asset and its useful life period.

Please note the legal disclaimer relating to this article.