Trial Balance: everything you need to know about stock

Everything in view: with a trial balance, you know exactly what property belongs to your company. All items, account balances, and debts are shown in this document, which must be regularly drawn up and updated. Your trial balance is also important for a correct balance sheet. That is why we’ll tell you exactly what a trial balance is and what to look out for when creating your own.

If your trial balance is incorrect or incomplete, it leads to incorrect annual financial statements. In the course of an audit, your trial balance will be the first point the auditor will work from. Should the tax office find any inconsistencies, it may consider the accounting to be incorrect and subsequently cast doubt on all your annual financial statements. This can result in substantial additional tax payments, and – in the worst situations – could be regarded as attempted fraud.

Trial Balance: defining the term

Your trial balance is comprised of the results of stocktaking. This is something that needs to be done once a year. You count, measure, or weigh all tangible assets and list all tangible, fixed, current, and intangible assets as well as all debts. This makes the trial balance the basis for your proper annual financial statements. In this directory, you don’t just list all items by type and quantity, but also by value. Totaling all items results is the current total value of your company.

Stock count

When you take over a company or create a new one, you need to create a complete stock count to determine the value of the company. You also need to take this step if your shareholders change at all (either old ones leaving or new ones joining) or if you give up or sell the company.

Since you need to include both tangible and intangible assets in a physical stock count, there are different types of physical inventory: you use a physical inventory to record all physical objects in your company. Raw materials, equipment, and production machines fall into this category, for example. These are counted, measured, or weighed. In exceptional cases you may also estimate, for example, whether large quantities of bulk material belong to the company. In addition to these items, other assets (or non-assets) are also included in the inventory, e.g. account balances and debts. To do this, you will need to carry out a paper inventory: you use documents (like bank statements) to check the book values, which should match your bookkeeping results.

The trial balance is a complete list of assets and liabilities that are part of the company on the balance sheet date. The inventory directory shows what is actually in your company, in addition to the results of your bookkeeping.

Creating an inventory

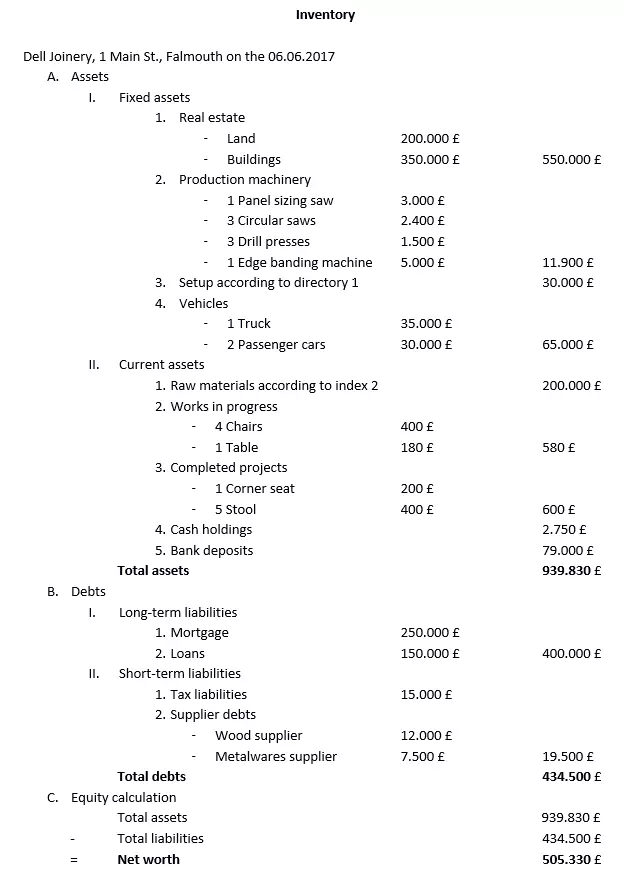

The inventory is divided into three areas:

- Assets

- Debts

- Equity capital

Assets include fixed and current assets. The former refers to all items that are permanently part of your company, like land and machinery. Current assets, on the other hand, include items that are only in the company for a short period, like raw materials. This also includes finished or semi-finished products that are still in operation on the day of the stock count and have not yet been sold. The second point in your directory is debt: all liabilities that you have not yet settled belong here. This also includes short-term invoices that still have to be paid. In addition, debt capital (e.g. bank loans) within the company counts towards the debt.

Finally, you calculate the equity capital from the two areas. This is your net assets, the difference between assets, and liabilities. It is the capital that your company raises itself. If equity is positive, it appears as liabilities in the balance sheet. If your debts exceed your assets and your equity is negative (i.e. missing), it belongs on the assets side of the balance sheet.

When designing your directory, you must also pay attention to certain structuring rules:

- All items must be numbered through

- You also divide the assets in your list into current and fixed assets

- In addition, you should sort your assets by increasing liquidity: the items that you can next convert into credits are listed at the end

- You divide the debts into short-term and long-term, sorted by due date

Your list must be orderly, clear, and above all, verifiable. Even uninvolved third parties – e.g. auditors – must be able to trace your records. However, a well-structured inventory list is worthwhile for you, because it serves as the basis for your balance sheet. You are obliged to keep your inventory lists for at least 10 years.

To make your final inventory list a bit slimmer, you can store the exact list of subareas in separate directories.

From inventory to balance sheet

The inventory is the basis for your balance sheet. This means that findings in the inventory list are included in the balance sheet, but not the complete inventory list. Whilst it is imperative that you specify all items individually when listing assets and liabilities, you can merge many line items in the balance sheet. They represent the assets in a compressed form.

The two documents also differ in structure: The inventory appears as a simple list, but a balance sheet appears as an account. This is a summary comparison of assets and liabilities. The quantity specifications of different items are also omitted – only values are relevant for the balance sheet. Finally, if the company is legally obliged to do so, balance sheets are also intended for publication.

Inventory: an example

To better understand the concept, we will give an example of exactly how to structure your inventory. Of course, each inventory must be adapted to the conditions of the company. In this case, we show the inventory of a fictitious carpentry business.

Click here for important legal disclaimers.