Writing sales receipts with correct templates

Creating sales receipts belongs to the canon of standard business practices, just as with writing invoices. Issuing a sales receipt can be a lot easier than issuing an invoice and with the correct template, it’s like child’s play. But what needs to be considered when creating a sales receipt and why do they have to be created in the first place? In this article, we will explain how to correctly issue a receipt and which obligatory details you shouldn’t forget.

What is a sales receipt and what is required?

A sales receipt is an acknowledgment confirming the payment for a service or a product. The document typically shows the date and time that the purchase was made, the items purchased, the amount, the method of payment and the shop’s details if the item was purchased from a brick and mortar location as opposed to over the internet. A receipt is important for maintaining your business records and preparing your tax return, so make sure to keep a copy. Receipts should be kept for at least the same amount of times as other business documents, which is a minimum of six years.

This is the information that should be included on a receipt:

- Your company’s details including name, address, telephone number, and/or e-mail address

- The date the transaction took place

- List of products/services with a brief description of each along with the quantity delivered

- The total amount, and also a breakdown of the amount to show VAT and any possible discounts

- The method of payment i.e. cash, credit, debit card, etc.

- The VAT amount

- Returns policy

What is the difference between a sales receipt and an invoice?

An invoice is a request for payment. It is generally a list of the products ordered or the services obtained and also features prices, credits, discounts, taxes, and the total amount. Many invoices state when the customer has to pay by (usually around 30 days), and whether there’s a discount if they are able to settle the bill earlier. You will most often find information related to the business such as the address, telephone number, and website address provided on an invoice.

A sales receipt shows that payment has been made and that a sale has been finalised. It can act as proof of ownership should something go awry. They are similar to invoices in that they include the goods or services, prices, discounts, taxes, the total amount paid, and the method of payment. There’s also the vendor’s and customer’s contact information.

When to issue the sales receipt

The sales receipt can be issued anytime after payment has been received from the customer unlike an invoice, which is issued before payment and states what the customer potentially owes.

How to create the sales receipt

You can issue a sales receipt electronically or on paper. It can be designed by hand e.g. using a receipt book or by using a digital sales receipt template on your PC. Special accounting programs can make your work much easier. With professional software, you have the possibility of connecting the task of creating sales receipts with your whole accounting. This not only saves you the processing work, but all the required data is automatically transferred to your sales receipt. This saves time and reduces the risk of errors. Depending on the number of receipts you need to write daily, a digital solution may be worthwhile.

If you don’t have the relevant software to produce sales receipts, or simply prefer to use paper so you have the receipt in physical form, you can simply purchase a receipt book. There are usually two copies per receipt (one for the customer and one for you). Alternatively, you can search for templates online and print them off to use.

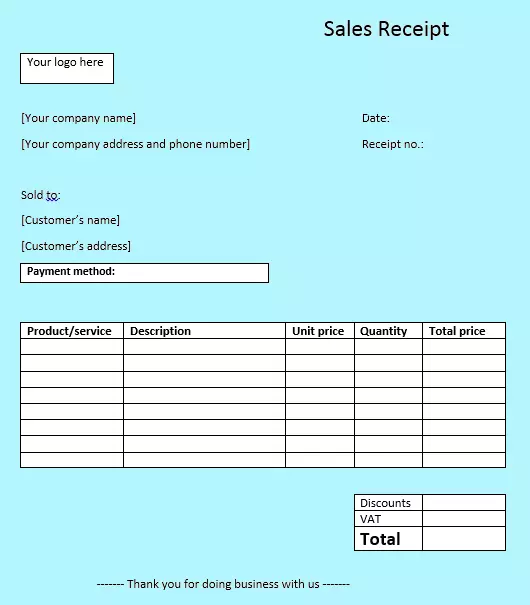

This is an example of how a sales receipt looks:

Click here for important legal disclaimers.