ROI – calculating return on investment

Business administration offers various profitability indicators that enable a company to measure its success and that of its investments. Ranking among the most important indicators of this type is return on investment (ROI). Below we’ll explain what you need to know about this indicator as well as how you can calculate ROI and interpret your company’s profitability.

What is ROI?

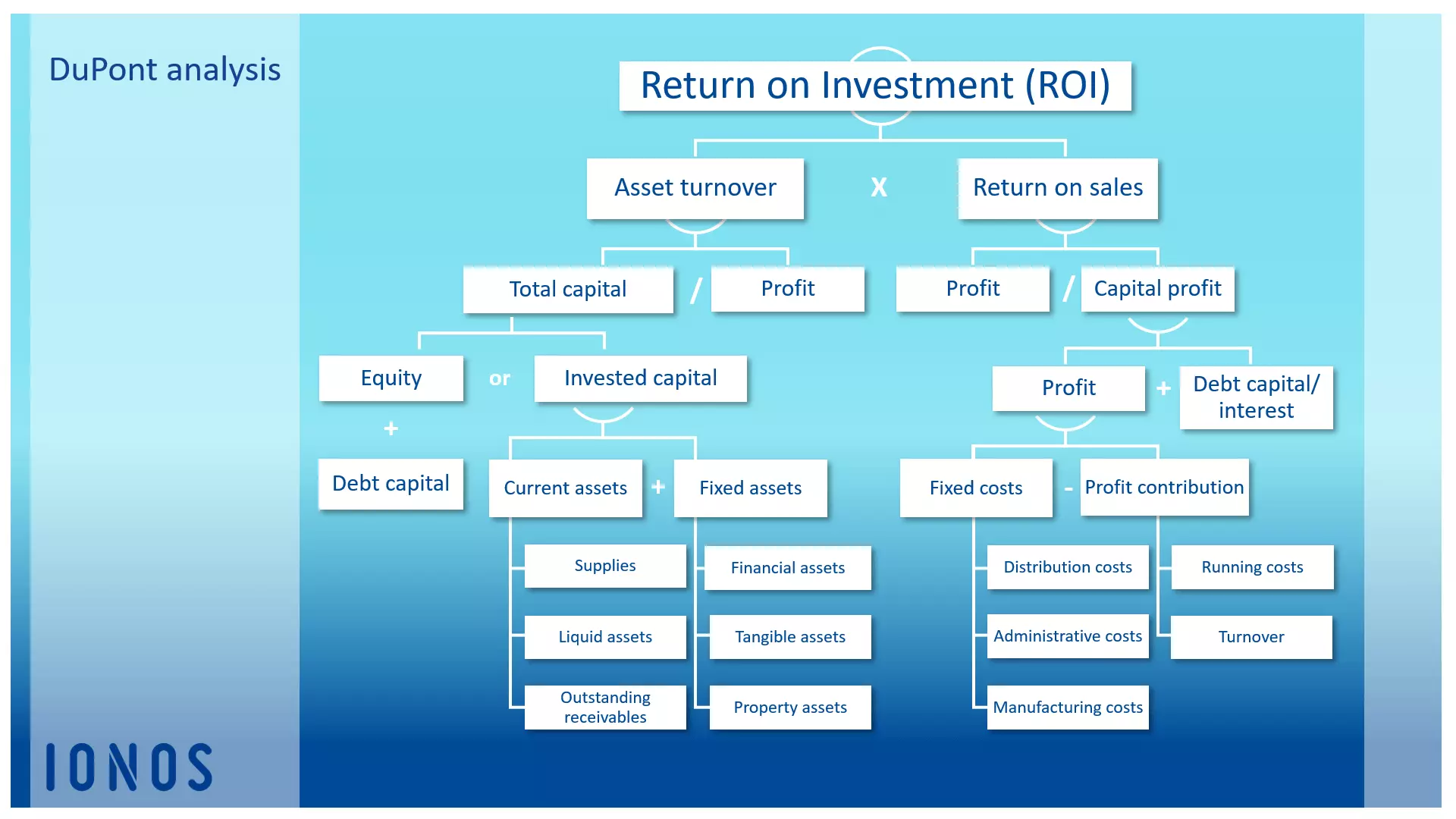

Return on investment is one of the most important indicators in accounting and has a long tradition. This value is situated at the top of the DuPont model and is thus at the centre of the world’s oldest business indicator system. This model was introduced in 1919 by the American chemical company E. I. du Pont de Nemours and Company. ROI refers to the return in relation to the invested capital.

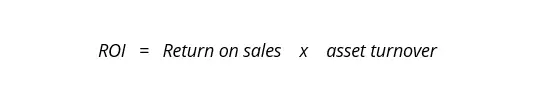

Return on investment (ROI) is an economic indicator for the profitability of an economic unit’s (e.g. a company) invested capital. In the DuPont model, this value is calculated as a product of return on sales and asset turnover.

Where ROI is used

Within the DuPont indicator pyramid, ROI is used to measure a company’s success while taking into account the entire capital investment. The value answers the following question: How effective was the capital investment over the course of the accounting period under consideration? In theory, however, ROI is suitable as a measurement parameter for any application case in which success is to be determined by the return on invested capital. Other examples of where it can be applied are:

- The evaluation of investments

- The comparison of investment projects

- The analysis of individual business divisions

Calculating the ROI

Which indicators you apply to calculating your ROI value depends on whether you are determining your entire company’s rate of return for a particular accounting period or whether you simply want to calculate returns from single investments or a specific business division.

The ROI formula

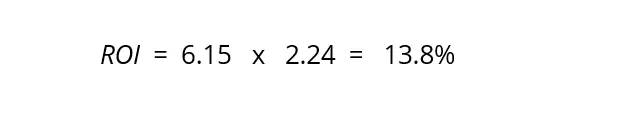

According to the DuPont model, your company's ROI is calculated by multiplying its return on sales by its asset turnover.

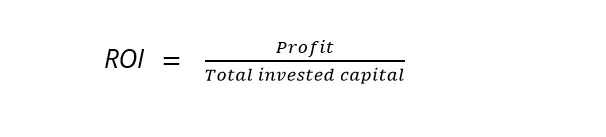

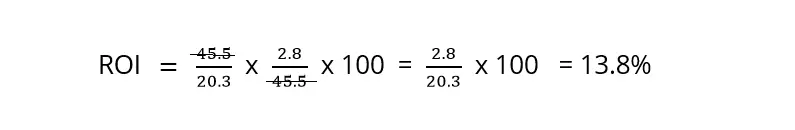

Alternatively, you can also calculate a company or investment’s ROI by dividing the profit by the total invested capital and multiplying the result by 100.

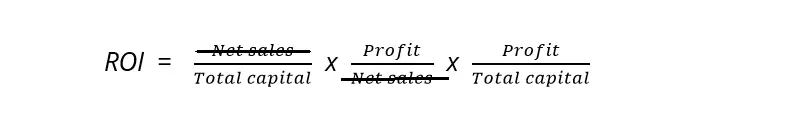

Both formulas produce the same result. This can be understood with the help of the following calculation.

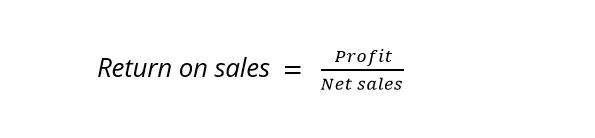

Formula for calculating the return on sales

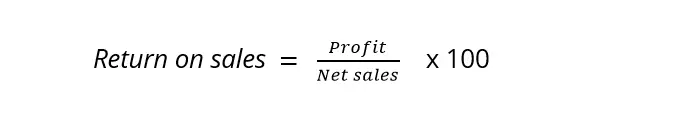

With the return on sales, you determine your company’s share of the profit made from the net sales.

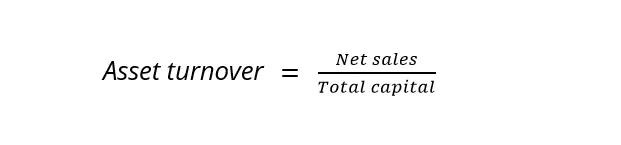

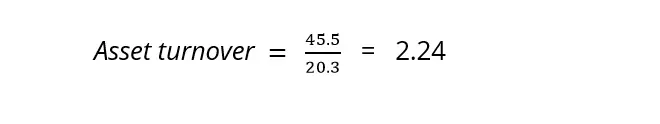

Formula for calculating asset turnover

Asset turnover provides information on your company’s profit ratio with respect to the total assets (equity + debt capital).

Formula for calculating ROI

In the DuPont indicator pyramid, the return on sales and asset turnover are located directly under the return on investment situated at the top. This is illustrated in the following graphic.

Example for calculating ROI

Below we use an example to explain the calculation of ROI. For this we begin by assuming that a company has the following figures for the accounting period under consideration.

| Net revenue | 45.5 million pounds |

| Total capital | 20.3 million pounds |

| Profit (before interest) | 2.8 million pounds |

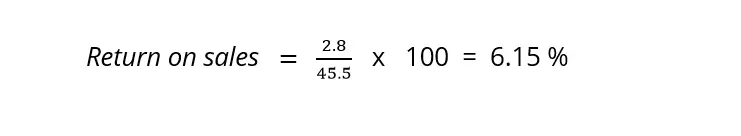

In order to calculate the ROI, we must first determine the company’s return on sales. To do this, we must first divide the profit by the net sales, then multiply the result by 100 in order to get the percentage.

For the company in the example, the result is a return on sales of 6.15%.

In the second step, we calculate the asset turnover. To do this, we divide the net sales by the total capital.

For the company in the example, the result is an asset turnover of 2.24.

Now we multiply the return on sales by the asset turnover and receive a ROI of 13.8% for the accounting period under consideration.

We get the same result if we determine the ROI using the alternative calculation method.

How to calculate the ROI of a single investment

If you don’t want to determine your entire company’s asset turnover but would rather determine the profitability of a single investment or that of a specific business division, then follow these instructions.

Divide the investment or business division’s profit share by the respective capital expenditure and multiply the result by 100.

These types of calculations are used in online marketing, for example, in order to figure out the success of advertising costs in relation to the profit they generate. In this context, it is referred to specifically as the return on marketing investment (ROMI).

Google recommends that website operators measure the success of advertising expenditures for AdWords advertisements by using the ROI it generates. The following example shows how to do this.

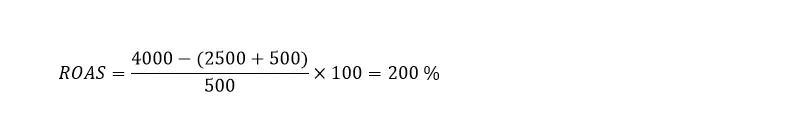

Imagine that you operate an online store and that you advertise your products in the search engine. For the purchase of articles, you incur a cost of 2,500 pounds which you use to generate 4,000 pounds in sales. The AdWords advertisements incur an expense of 500 pounds.

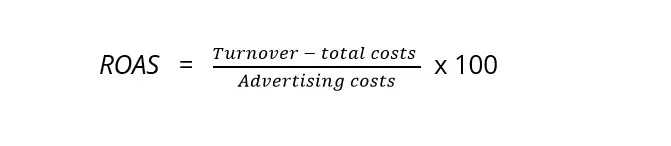

You can calculate the success of your marketing investments by dividing the profit share by these advertising costs and multiplying the result by 100. To do this, you can use the ROAS formula (return on advertising spend). It generates a ROI that refers to a specific profit share and the advertising costs that were spent to obtain it.

An ROAS of 200% is the result for this example.

Differentiation from other profitability indicators

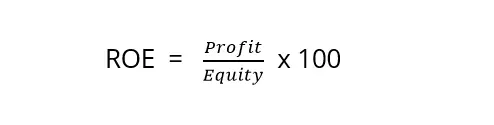

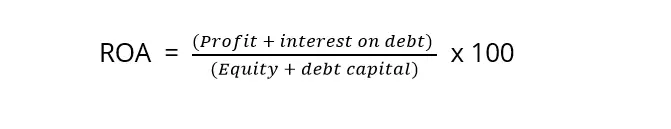

As the top indicator of the DuPont model, return on investment (ROI) includes both the return on equity (ROE) and the return on assets (ROA), which consists of equity and debit capital.

Return on investment (ROI)

Return on Equity (ROE)

Return on Assets (ROA)

Interpreting the ROI

Return on investment sheds light on the profitability of fixed capital. It can involve a company’s entire capital or the capital expenditure for a single investment.

The ROI is a measurement of this capital’s return. How you evaluate a ROI figure in the long run depends heavily on the sector in which the company is active or makes investments. Many business professionals aim for a return on investment that is more than 10 percent. On average, however, higher ROI values are obtained in commerce than industry. Within a company, determining the ROI value provides an opportunity to compare various investment projects or business divisions in terms of their profitability.

Criticism of ROI

Calculating ROI is considered one of the standard procedures for evaluating investment projects, both in forecasts and in the subsequent performance review. The indicator is quickly determined and also implies reproducibility. When it comes to describing financial implications, however, the ROI itself has limited informative value: when considering individual cases, repercussions within the overall context can fall by the wayside. Flaws emerge both in the analysis of the company’s overall results as well as in the evaluation of single investments.

- ROI is a book-value based indicator that generally only allows conclusions to be drawn about the past. ROI is not suitable for evaluating future investment projects.

- Investment risks and external influence factors aren’t taken into consideration when using ROI. These include economic and market risks, customer satisfaction, and competition.

- As ROI refers to a specific period under consideration, it is difficult to compare investments with varying terms. Furthermore, it isn’t always possible in practice to clearly match a company’s sales and profits to specific investment projects.

With the ROI, you determine the return on invested capital based on the company figures that are available to you. The profitability of future investment projects cannot be reliably determined using the ROI.

Please note the legal disclaimer relating to this article.