How to record capital contributions and withdrawals correctly

On a day to day basis, it’s normal for money to be transferred from a company account to the business owner’s personal account for private purposes. This is also referred to as a drawing. Alternatively, the owner may inject their own money into a company during the course of the business.

For small businesses (sole proprietors) and partnerships, these financial transactions do not pose a problem as long as they are correctly accounted for. If your bookkeeping isn’t in order, issues with the HMRC could arise.

As far as the HMRC is concerned, any money a sole proprietor takes out of the business is not considered a business expense. Drawings are part of a self-employed person’s income and all income is subject to tax. Things are different for limited liability companies where the company owner is treated as a separate entity from the business and therefore taxed through the UK’s PAYE system.

Contributions and withdrawals: How to record them properly.

Two things are important when it comes to recording the contributions or draws:

- The value of the cash injection or draw

- Which accounts the money was transferred to

For more information, read our focus articles on capital contributions and withdrawals.

You may use single or double-entry bookkeeping to record your incoming and outgoing cash. A single-entry balance sheet is a simple record of your deposits and payments. This is only suitable for very small businesses or sole traders.

If your business is of medium size or requires more complex accounting, you should opt for double-entry bookkeeping. In this case, two entries are made for a single transaction: a debit and a credit. When it comes to private withdrawals and deposits, simply record the amount of outgoing and incoming cash, respectively. Most balance sheets of private accounts will show withdrawals on the left (debit) and deposits on the right (credit).

You can also record sales and purchases at a time when cash has not yet been transferred. This is called accrual accounting.

Most company accounts will consist of:

- Asset account (includes a company’s cash accounts, inventory, property and things it owns; accounts receivable)

- Liability account (monies or items owed by the company to others; accounts payable)

- Equity account (claims made by the owner or investors)

When you’re balancing your business accounts, you want to make sure that your liabilities and equity equal your assets. As the business owner, you can record personal account balances either on the left (more withdrawals than deposits) or on the right (more deposits than withdrawals). The private accounts are thus either a burden or relief on equity.

Bookkeeping in practice: Private contributions and withdrawals

To understand the correct bookkeeping procedure, we’ll explore the different options using examples. We’ll start with the simplest form:

Recording cash contributions and cash withdrawals

When it comes to cash contributions or withdrawals, you may transfer funds (either in cash or by bank transfer) between your personal account and a company account. In this case, let’s assume that you take the money out of the cash register and pay a different amount of money back at another time.

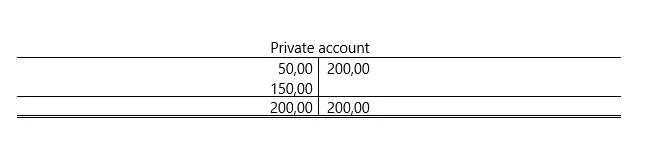

First, you take £50 from your company’s cash register:

Private withdrawal £50,00 from the cash register £50,00

Then you put £200 back into the cash register:

Cash register £200,00 as a private deposit £200,00

Using double-entry bookkeeping, your account balance would look like this:

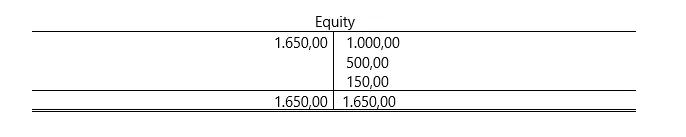

To balance out the account, you must enter a balance of £150 in the debit column. This is included as credit in the balance sheet of the equity account section:

Recording a non-cash withdrawal

Now, let’s imagine that instead of making a cash withdrawal, you take a product from the company for private use. In this case, you would record the list price of the item, i.e. the price that you would charge a customer inclusive of sales tax (if applicable). The item withdrawal must be registered separately. For example, let’s assume the net price of a chair is £120.

Private withdrawal £120,00

- A withdrawal of an item for private purpose £100

- Plus sales tax at 20% £20.00

You can make up your accounts using the same balance sheet method shown above.

Recording private usage

If you don’t remove an item but instead use it privately, you should record this usage which may be tax-deductible up to a certain amount. This would apply, for example, when using the company car privately. In the UK, journeys with a company car to and from work are considered personal trips.

The amount of tax you need to pay for your company car when making private journeys depends on:

- The car’s P11d value

- Its CO2 emissions (the higher the emissions, the higher the tax)

- Your tax bracket (20 per cent or 40 per cent)

To work out how much company car tax you owe, the following calculation applies:

- Find the right P11d value of your car

- Multiply the P11d value by the correct company car tax band

- The resulting figure is your benefit-in-kind (BIK) rate

- Multiply the BIK rate by your income tax percentage

The result will be the amount in tax you own annually for a company car. To be made exempt from company car tax, you should not use it for private journeys. You can reduce your company car tax by getting a car that emits less CO2.

Alternatively, you can register it as a ‘pool car’ for multiple members of staff to share for business purposes.

Rare and short personal trips using a company car do not usually have to be recorded.

Recording a capital contribution

In our final example, let’s look at a capital contribution in the form of an asset and how these are accounted for. Let’s say you bought a PC a year ago which was primarily used by your child. However, they have now moved away to college and are no longer using the PC. You want to hand over the PC to your company and specify the acquisition cost as a partial tax-deductible contribution.

You originally paid £1,200 for the PC. The computer’s value has declined over time and is now worth £800. The PC would be recorded as follows:

Other operating and business equipment £800.00 in Private deposits £800.00

As long as you can justify that the computer is solely used for business purposes, it falls under capital expenditure.

These are highly simplified examples. In reality, each situation will differ and require individual consideration. Capital accounts of each partner in a partnership may require advanced accounting methods.

Please note the legal disclaimer relating to this article.