What is a P&L account?

Apart from balance sheets, profit and loss (P&L) accounts are an important cornerstone and a key element of annual financial accounts, with the aid of which businesses state the sources of their income and expenses to determine the annual result. In other words, P&L accounts contain information relevant to a company’s turnover during a financial year. It is therefore important that all accounts are assessed correctly. If your business recently incurred a profit or a loss and you want to avoid making bookkeeping mistakes, read this guide to find out exactly what a P&L account entails, how the calculations should be carried out, and what it should look like.

Essentially, the P&L statement forms part of a balance sheet and is used to determine net assets of a company. What it also takes into account are the company’s liabilities. As a result, it not only provides insight into the financial side of things, but is also of interest to third parties such as investors and accountants who can precisely retrace all necessary information about a company’s profits and losses.

Who is responsible for issuing P&L statements?

In general, all merchants are obliged to compare their income and expenses to determine respective profits and losses. This also lets you deduce what the taxable amount is. All related rules and regulations can be found in the respective commercial codes and taxation legislations for the United Kingdom. International accounting standards like the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles in the United Kingdom(UK-GAAP) also require such accounts. Creating P&L statements also applies to merchants who must conform to double-entry bookkeeping methods.

The P&L statement forms part of an annual financial account and must be recreated each financial year. However, it is possible (and also partly recommended) that a P&L account is carried out more than once over the course of an ongoing financial year. For instance, many businesses determine their income and expenditure on a monthly basis. In this way, they are more aware of their most recent financial status and can react much quicker to a potential negative trend. Moreover, most businesses are obliged to publish not just a P&L statement but also an annual financial account. Disclosure obligations therefore apply to all large and capital companies.

Structure of a P&L account

There is no legally-binding form indicating the correct structure of a P&L account. However, you should stay as close as possible to the Generally Accepted Accounting Principles in the United Kingdom. Above all, the aim is to structure the accounts in a neat and clear manner and supply them with all necessary information. In principle, what is not allowed are accounts in which the bookkeeping approach contradicts the very purpose of a P&L account. In other words, each item affecting the correct assessment of profits and losses must be taken into account.

With the aid of a P&L statement, one intends to make the assembled profits or losses as comprehensible as possible. You should therefore include each item so that the result can be accurately reviewed. The legislator distinguishes between the gross and the net principle, whereby the difference depends on whether or not your expenses and earnings can be offset against one another. Generally speaking, however, the gross principle does not offset.

The net principle is only intended for small and medium-sized corporations, where individual items are offset against one another and balanced in P&L accounts. In doing so, expenses and earnings of the same kind are added up. For example, it is common practice for the net principle to balance interest expenses with interest earnings.

Account form

The account form takes into consideration two columns, namely the debit (left intended for all expenses) and the credit side (right intended for all the earnings). The main advantage of this method is that the two-column display weighs expenses and income in a more visible fashion than the report form. In addition, the account form includes the total of the two columns, which makes the total profit and loss more clear.

Profit and loss account

| Debit | Credit |

| Cost of sales | Sales |

| Staff costs | Fixed-income security |

| Repairs | Other operating income |

| Advertising | etc. |

| Depreciation | |

| etc. | |

| Total (profit) | Total (loss) |

Report form

In the report form, you arrange the individual entries into various groups. Income and expenses form joint groups, with each one of them receiving its own subtotal. Each component contributing to the total is shown separately, which makes the source of earnings more visible. This form of a P&L account allows the progression of profits or losses to be more easily traceable, as each group of items individually contributes towards the final result.

Profit and loss account

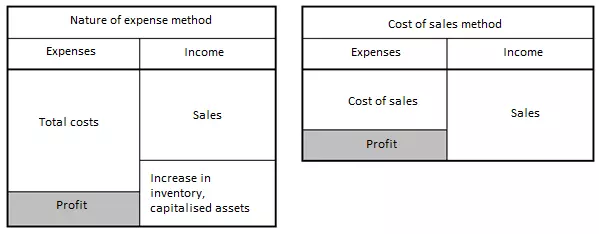

There are two ways in which you can create a profit and loss account – either by means of a nature of expense method or by a cost of sales method. They differ on the basis of what you include in your P&L account, and their structure varies accordingly.

The International Financial Reporting Standards (IFRS) allows both methods.

Nature of expense method

In this method, what is taken into account are all costs and payments. In contrast to the cost of sales method, it also includes payments that have not yet been settled. Since the cost of materials is also incorporated, the result is the same as for the cost of sales method, with the subtotals as the only difference. The calculation includes various production and expense categories, whereby income and expenses are sorted according to their type. For example, primary cost elements are classified either as staff or material expenses.

Profit and loss account

| 1. Sales revenue | |

| +/- | 2. Increase or decrease in finished and unfinished goods and services |

| + | 3. Other capitalised services |

| + | 4. Other operating income |

| 5. Cost of materials | |

| - | a) Costs of raw, auxiliary, and process materials and of purchased goods |

| - | b) Cost of purchased services |

| 6. Staff expenses | |

| - | a) Wages and salaries |

| - | b) Social security contributions and expenses for retirement benefits and support payments |

| 7. Depreciation | |

| - | a) of fixed intangible and tangible assets |

| - | b) of current assets to the extent that these exceed the ordinary depreciation for the corporation |

| - | 8. Other operating expenses |

| = | Total operating result (earnings before deducing interest and taxes) |

| + | 9. Income from investments |

| + | 10. Income from other securities and loans held as financial assets |

| + | 11. Other interest and similar income |

| - | 12. Depreciation on financial assets and securities held as current assets |

| - | 13. Interest and similar expenses |

| +/- | 14. Taxes on income and earnings |

| = | 15. Net earnings |

| +/- | 16. Other taxes |

| = | 17. Annual net profit/annual net loss |

A profit and loss account in report form (and according to the nature of expense method) mentions sales revenue as the first item. In the past, it was only income generated by ordinary business activities that were included. Nowadays, the scope of the term has been extended to include income from side businesses.

Increase or decrease in stock is understood as the difference in the inventory levels of both finished and unfinished products at the beginning, as well as at the end of a given observation period (this period usually being the financial year of a company). What you observe here are changes in quantity and value, such as those caused by the natural wear-and-tear or other depreciating factors. However, changes in inventory are not recorded here, but rather under material cost. Other capitalised services consist of self-made items, such as buildings or machines that have been built or manufactured by a company’s own workforce and are intended to remain available for the company’s operations. Such self-manufactured assets are then subject to depreciation over the course of their useful life.

The rather vague concept of other operating income simply sums up all income that does not fit into all other income-related categories. Material costs, on the other hand, are split into two different categories – point 5a including all costs of raw, auxiliary, and process materials, as well as purchased goods (which do not appear under point 2 and may also include changes in inventory caused by theft). Point 5b takes into account all services received from third parties in the course of the production (such as machinery repairs).

Staff expenses cover all employee-related costs. You should divide them into wages (6a) and corresponding social security contributions (6b). The expense method also divides depreciation into two sub-categories: depreciation of fixed assets (7a) and depreciation of current assets (7b), which exceeds the level of regular depreciation within a company. Other operating expenses include all costs of operational processes that were not suitable for any of the previous points.

The abovementioned items of the P&L account count towards the total operating result, whereas all of the remaining items are to be assigned to the financial result. Its first item, income from investments, includes the likes of income from dividends or profit shares. These stand in contrast to income from other securities and loans (10), which take into account the income that the company has obtained from interest rates. The financial result also includes other interest and similar income, where you should include all other financial income that cannot be assigned to either of the other two items.

It is now time to subtract depreciation on financial assets and securities held as current assets. In contrast to those listed in point 7, the depreciation in question relates to the financial sector and not to the operating sector. What must also be subtracted is interest and similar expenses, which are subject to payment by your company. After deducting operating taxes (split into two categories), the calculation of your annual net profit or annual net loss is now complete.

Cost of sales method

The cost of sales method compares sales revenue with the manufacturing or acquisition costs incurred only from products sold. In contrast to the nature of expense method, it is based on a cost-center approach. In this way, sales revenues are directly set against sales-related production costs. Other operating expenses are listed according to various subsectors, such as sales, administration, and other expenses. The disadvantage of this procedure is that material and staff expenses are not listed separately.

Profit and loss account

| 1. Sales revenue | |

| - | 2. Production costs of goods and services needed to generate sales revenue |

| = | 3. Gross profit from sales |

| - | 4. Distribution costs |

| - | 5. General administrative expenses |

| + | 6. Other operating income |

| - | 7. Other operating expenses |

| = | Total operating result (earnings before deducing interest and taxes) |

| + | 8. Income from investments |

| + | 9. Income from other securities and loans held as financial assets |

| + | 10. Other interest and similar income |

| - | 11. Depreciation on financial assets and securities held as current assets |

| - | 12. Interest and similar expenses |

| +/- | 13. Taxes on income and earnings |

| = | 14. Net earnings |

| +/- | 15. Other taxes |

| = | 16. Annual net profit/annual net loss |

In order to create a profit and loss account, the cost of sales method also requires that you start your calculations with sales revenue (by proceeding in the same manner as with the nature of expense method). However, this method differs from the second item onwards (namely from the production costs of goods and services needed to generate sales revenue). What is considered here are all costs arising directly from the manufacturing process, which also include the depreciation of these assets as well as corresponding depreciation and costs incurred during the research phase.

The gross profit from sales is obtained after subtracting the second item from the first. This result shows the sales performance of your company. Upon further calculation, distribution costs also come into the equation. It is with the aid of this items that you sum up material and staff expenses as well as depreciation (only if they arise from your sales and production). All other sales expenses such as marketing costs are also added. However, these do not include administrative costs, which should be summed up under general administrative costs. These items also include corresponding staff and material expenses as well as all depreciation-related figures.

To obtain the total operating result, simply add other operating income and subtract other operating expenses. Thereafter, the first item on the list consists of investment income or even income from currency conversions. Corresponding expenses include, for example, losses on disposal of valuable objects. It is important to note that the two items in question only include income and expenses that were not suited for any of the other categories. All of the remaining items that you specify in the cost of sales method are treated in the same way as in the nature of expense method.

The cost of sales method is also used to determine the annual net profit or annual net loss. Regardless of which method you choose, you obtain the same final result.

Nature of expense methods vs. cost of sales method – a comparison

Two examples are used to show how the two methods in question differ from one another:

A joinery produces 1000 chairs during a given financial period. It costs £10 to produce each chair, whereas each is later sold for £20. End-of-year figures show that 800 were sold, while 200 remained behind. In addition, the joinery has additional costs that cannot be directly assigned to the production costs, such as accounting expenses amounting to £2,000.

In this example, calculations end at the total operating result. Remaining corresponding income and expenses are identical in both methods and are therefore not included from this this point on.

Profit and loss according to the nature of expense method

| 1. Sales revenue | £16,000 | |

| + | 2. Increase in finished products | £2,000 |

| - | Expenses from points 3 to 7 (including other operating income) | £12,000 |

| = | Total operating result (earnings before deducing interest and taxes) | £6,000 |

In this simple example, sales revenue is calculated by the number of chairs sold multiplied by the sales price: 800 x £20 = £16,000. The second item points to all chairs that the company has produced but has not been able to sell. In this case, the number of unsold chairs is multiplied by the production cost and this value is added to sales revenue, as it represents a positive value for the joinery: 200 x £10 = £2,000. Subsequently, the joinery’s bookkeeping costs decrease the total earnings and are interpreted as costs incurred during the manufacturing process.

For reasons of clarity, we add together the expenses from items 3 to 7, combining staff and material expenses. In a correctly filled-out profit and loss account, however, all information must be provided separately. At this point, other expenses (such as administrative costs) also come into the equation.

Profit and loss according to the cost of sales method

| 1. Sales revenue | £16,000 | |

| - | 2. Production costs of goods and services needed to generate sales revenue | £8,000 |

| = | 3. Gross profit from sales | £8,000 |

| - | Expenses from points 4 to 8 | £2,000 |

| = | Total operating result (earnings before deducing interest and taxes) | £6,000 |

Both methods record sales revenue in the same way. In other words, the cost of sales method also starts off by taking into account sales revenue that results from products sold. In the next step, however, what is not taken into account is the proportion of those products that have not yet been implemented. Instead, only the production costs (including costs for materials and staff) are introduced in order to calculate the gross profit from sales. Additional expenses are then deducted separately. In the end, however, the total operating result is identical to that of the nature of expense method (£6,000 for both).

From profit and loss accounts to balance sheets and annual financial statements

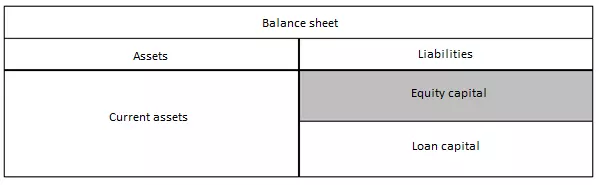

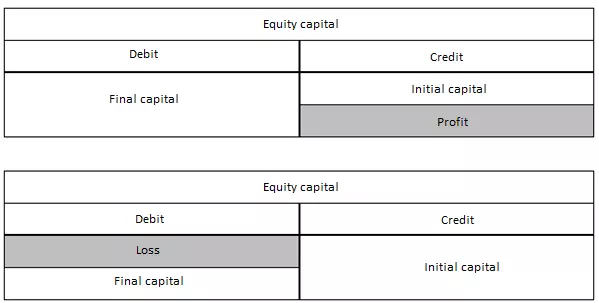

The profit and loss account forms part of the annual financial statement and is an integral part of the balance sheet. It provides a more detailed overview of equity earned and is able to break it down into several components. A P&L statement is therefore a separate account which forms part of the equity account and appears as such in the balance sheet on the liabilities side.

Aside from cash flow statements and annexes, annual financial statements present balance sheets and profit and loss accounts separately. Each year, they are the fruit of your bookkeeping, which inform either about the success or failure of your company.