What is a balance sheet, and how do you create one?

In order to determine your company’s profits or losses, and to be able to calculate taxes at the end of the financial year, you need to record book of entry. Bookkeeping records all business transactions for a company, and serves as the basis for the profit and loss account and the preparation of the balance sheet. Together with the income statement, the balance sheet is a main component of the annual report. But what exactly is a balance sheet, and how is it created?

What’s included in a balance sheet?

The balance sheet is a statement of a company’s assets and liabilities at a given point in time. It’s divided into two parts, with the assets on the left and the liabilities on the right. The assets side provides information on the company’s resources. The liabilities side shows the company’s obligations. It’s important that the total sum of assets always matches the total liabilities.

The assets side provides details about the forms of the assets and their accumulation as well as the distribution of the company’s funds and investments. The liabilities side lists the sources and financing of those assets.

The trial balance forms the basis for the balance sheet, which lists all assets and liabilities individually at their value. On the assets side, for example, there are buildings, receivables, cash, equipment, etc. This is then counteracted on the liabilities side, which records equity, debt capital, and money owed to suppliers. The items listed are summarised in the balance sheet and allocated to one side or the other. In simple terms, equity capital can be calculated from the balance sheet by deducting borrowed capital (liabilities) from the total assets. In short, the following applies:

Assets = liabilities (capital)

Assets = equity + liabilities

Which can be rearranged into:

Equity = assets - liabilities

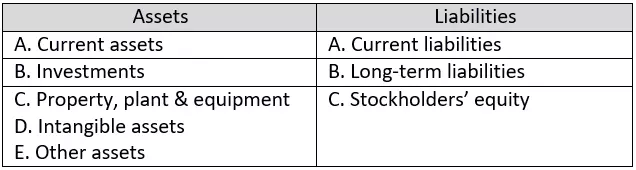

The abbreviated layout of a balance sheet looks as follows:

The assets are organised according to their liquidity. The liabilities are structured according to their maturity, and cover the entire financing of the company.

- Up to 50 GB Exchange email account

- Outlook Web App and collaboration tools

- Expert support & setup service

Who must create a balance sheet?

The UK has no specific requirements about how you choose to keep your books, and the creation of a balance sheet can be excluded depending on the type of business. In general, though, balance sheets are required and must contain a certain amount of information. The structure and size of the balance sheet can be flexibly based on the size of the company and the required complexity. Small businesses, for example, tend to have much simpler balance sheets than large corporations. Even as an entrepreneur, though, a balance sheet and profit and loss report are a good idea to help keep track of your financial performance. Unincorporated businesses in the UK are not required to create a balance sheet, though they may still choose to do so.

Depending on the size of your business, the reporting requirements may change. Be sure to consult account filing standards provided by the HMRC before preparing financial statements to make sure not to miss anything.

As a freelancer, you are not required to follow accounting obligations for businesses.

The goal of a balance sheet is to provide information about the financial health of a company at a point in time. It also documents the company’s compliance with accounting regulations. The profit and loss report, together with the balance sheet, makes up the annual report, and is carried out before the balance sheet is created.

What types of balance sheets are there?

There are few basic types of balance sheets which you can create to suit different purposes.

Classified balance sheet

The most popular type, a classified balance sheet divides information by subcategories. These categories are then classified to make it easy to find the information in question. There are no requirements about which categories must be included, but maintaining a consistent structure simplifies the process of comparing information over multiple periods.

Unclassified balance sheet

An unclassified balance sheet doesn’t employ the categories and subcategories of the classified version, and instead lists all items at once. Assets are generally ordered first, followed by liabilities. There are no subtotals as would be included in a classified balance sheet, but instead totals are listed for assets, liabilities, and equities. This type of balance sheet is mostly suitable for small reports with few items to list, or for internal reporting purposes. Assets are listed according to their liquidity, with cash assets at the top and fixed assets at the bottom. Liabilities are also presented in a similar manner, generally organised by due date.

Comparative balance sheet

A comparative balance sheet is used to compare account balances at multiple points in time. This is particularly useful for gaining an overview of the company’s general financial position, i.e. the trajectory of its net worth and debts. The subtotals for the various points in time are presented side by side. Comparative balance sheets are the required form under FRS 102, just like with the old UK GAAP.

Interim balance sheet

Since balance sheets are composed to encompass an entire fiscal year, the term “interim” does not really apply to them. However, interim financial statements can be useful to present periods that cover less than one year. For example, publicly-held companies that are required to issue quarterly reports may make use of interim balance sheets. Since the balance sheet is only used to refer to a specific point in time, not a span of time, the interim balance sheet will differ slightly from the other reports included in an interim financial statement.

How do you create a balance sheet?

The structure of a balance sheet usually follows the classified style (see above). The values for the individual items are taken from data in the accounting records that were used to record all business transactions for the fiscal year. For example, if the purchase of a machine was financed with a loan, then the value of the “property, plant, and equipment” (asset side) increases – and so does the value of the corresponding liability on the other side. Depreciation for wear and tear, i.e. the deterioration of the machine, and the interest paid on the loan are recorded in the profit and loss report to adjust profit totals. The calculated profit or loss is shown under the balance sheet item “equity” on the liabilities side of the balance sheet.

Assets

On the assets side, a distinction is made between current assets and non-current assets. The difference is based on how long they’re held for. Here, fixed assets are long-term, such as machinery and vehicles. These valuables remain in the company for a longer time. Current assets, on the other hand, are “in circulation”, i.e. finished products, goods, and items that the company needs for further processing (material), as well as receivables from customers (open invoices), cash, and bank assets.

Property, plant, and equipment includes long-term assets that are acquired for operational use in the company. Acquisition costs for these assets depreciate as they’re used, depending on the asset and annual wear and tear, on a pro rata basis, which reduces the profit. It’s then recorded in the balance sheet at the respective carrying value.

Short-term investments, such as raw materials, are not depreciated. The costs for their acquisition are fully deducted from the profit, since they serve the purpose of making the current profit. The value of raw materials reported in the balance sheet comes from the company’s inventory at the balance sheet date, which is determined by means of the annual stock count.

Liabilities

The liabilities side shows the source of the capital. It records equity, provisions, liabilities, and, if applicable, deferred income as well as deferred tax liabilities. The liabilities show where or to whom the company owes something and what the owner is entitled to.

On this side, maturity is important. Stockholders’ equity is regarded as long-term capital that remains in the company for a long time, with other long-term liabilities such as mortgages and bank loans listed below. The situation is different for short-term liabilities, such as supplier invoices – these are usually settled within a few days and therefore are positioned lower than long-term liabilities.

Provisions are liabilities whose value isn’t yet determined: These include taxes, pension payments, and anticipated litigation costs from pending proceedings.

Accruals/prepayments result from payments that occurred at a different time than when the service was used. On the assets side, an example of this would be advance rent payments, say if the rent for January and February was paid in December of the previous year (prepayment). On the liabilities side, examples would be services that were invoiced in advance but not rendered until the following financial year, such as advances (accrual).

Generally speaking, the creation of a balance sheet and income statements requires a certain amount of expert knowledge. Though you’re certainly not required to, it’s advisable to hire a tax consultant to prepare your annual financial statements – not least because you can avoid any costly corrections at a later date, but also because both the tax authorities as well as banks appreciate preparation by an independent third party.

The balance sheet is a snapshot from the recording date which can change within just a few minutes, so long as it is recording an active company.

Click here for important legal disclaimers.