Collective invoice: settling multiple collected orders

The principles of proper accounting state that each and every transaction made by a business must be proved by means of an invoice. The same calculation however, can be used for multiple business transactions. When doing so, the term collective invoice is used.

What is a collective invoice?

A collective invoice is an invoice for several goods or services provided to a customer within the agreed upon invoicing period. But what is the advantage of collective invoicing versus individual statements? And what do entrepreneurs need to consider when they combine several transactions into a single invoice?

Arguments for collective invoicing

As a summary invoice for several orders, a collective invoice can always be made available if a business provides regular services for a single customer over a longer period of time, and wants to settle these periodically. The goal is effective, low-cost accounting. If several business transactions accumulate and are then paid off by the customer, there are fewer account transactions. In turn, this leads to fewer transaction fees for businesses and customers alike, as well as saving money.

Fields of application

In practice, collective invoices are always used when deliveries to regular customers need to be billed efficiently and cost-effectively for both suppliers, and customers. Here is an example:

Mr. Smith, the master painter, ordered paints, brushes and other materials for his company from the same wholesaler. Instead of paying for each material individually, he settles outstanding invoices on a monthly basis. As a result of this, the wholesaler completes each order with a separate delivery note, and issues Mr. Smith with a collective invoice for all services incurred during the invoicing period (the last month).

Another area where collective invoices are helpful is long-term supply agreements. For example, the invoice from the electricity provider represents a collective bill over the agreed upon billing period. Physicians and hospitals generally issue collective invoices to health insurance companies, which summarise the individual statements on the health services provided. The same is done for any billing which may fall directly to the patients themselves if their health insurance does not cover a specific procedure.

Collective Invoice requirements

Collective invoicing is subject to the same requirements as individual invoices. While there are no separate legal requirements for collective invoices in the UK, your business may be subject to different regulations depending on the industry, so it would be in your interest to consult these before taking steps towards creating a collective invoice. That having been said, it is best practice to ensure that your collective invoice provides the same information as an individual invoice for each item or service.

Information provided to the supplier should include:

- Supplier Name

- Supplier Address

- Unique Invoice identification number

- Supplier’s VAT registration number

- Supplier’s telephone number, contact person and email address

- Bank Information (IBAN code in the UK, bank name, address and account number)

Information provided to the account holder should include:

- Name of legal entity and invoice address as stated in the purchase order

- Account holder’s purchase order number (one purchase order per invoice).

Recommended information:

- The word INVOICE or CREDIT

- Invoice number

- Invoice date

- Currency type (monetary code, eg. GBP). This will be the same currency as stated in the Purchase Order

- Specification of goods and services delivered; line items in the purchase order should match the invoice

- Total net amount

- Tax amount. If multiple taxes are applicable, the tax rate for every net amount should be specified.

- For credit notes, invoice numbers being credited must be stated (one credit note per invoice).

In addition, HMRC (Her Majesty’s Revenues and Customs) stresses the following additional requirements for summary invoices:

- The collective invoice must summarise the charges for the individual sales of a transfer period. The same applies for any additional tax amounts accrued.

- If this information is not provided on the collective invoice, you can refer to the supplementary documents.

While the ongoing billing data (delivery notes) can be transmitted in a secure EDI procedure, you must transfer the collective invoice either in paper form, or electronically, including a qualified electronic signature

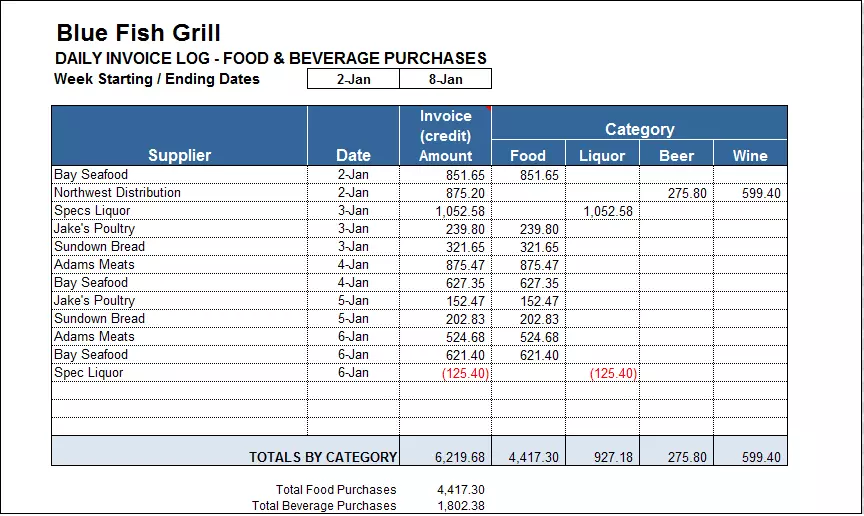

Collective invoices sample

Now, we will show you how to create a collective invoice using an example. The following invoice lists several deliveries to the same customer. The respective order number, delivery date, scope of the delivery and the invoice amount appear as due per item and per delivery for each business transaction. At the end of the collective invoice, the invoice recipient finds the total amount for all deliveries during the billing period, as well as the estimated tax, including the tax rate itself.

Click here for important legal disclaimers.