Cold progression

Not many people like to pay taxes. So it’s all the more annoying when you pay even more than you actually need to – due to secret tax increases. One of these increases is known as cold progression. This social and political topic has been debated again and again although many aren’t aware of it, since the topic is primarily discussed by economists. But since it really affects every single taxpayer, you should know what cold progression is all about.

What is cold progression? A definition

The term “cold progression” describes the situation when prices rise due to inflation, but income tax rates are not lowered because of it. This means that although you can afford fewer things with your income, the amount of tax remains the same. Every Brit has to pay taxes on their income. If you earn more, you pay more taxes. It is required due to the principle of efficiency: A higher income enables people to make a greater contribution to financing state services. Our tax system is therefore based on a progressive income tax rate. This means that someone who earns more pays a higher average tax rate than someone who earns less. This is also called normal progression.

Cold progression can only happen in tax systems with progressive income taxation. In systems where all taxpayers pay the same tax rate at a flat rate, this cannot happen, because a higher income does not cause a higher tax rate.

It’s important to know the distinction between nominal income and real income in order to understand cold progression. The former is the amount of money that ends up in your account. The term “real income,” on the other hand, takes into account the purchasing power of this income. So with real income, you ask yourself how much you can actually buy for the money you earn. The consumer price index is used to calculate purchasing power. This index measures the average price development of the main goods and services and is the basis for calculating the inflation rate.

A distinction is made between cold progression in the narrower sense and cold progression in the broader sense.

Cold progression in a narrower sense

Cold progression in a narrower sense always occurs when real incomes decrease and the state does not react by lowering the tax burden. Real incomes can fall even if nominal incomes increase. Why is this the case? If the nominal income increase is lower than the inflation rate, you can buy less for your money than in earlier times when inflation had not progressed as much. Put simply, your money is worth less. Your real income is decreasing even though your nominal income is rising. But what also happens is that due to the higher nominal income, you slip into a higher tax rate. So you pay more taxes even though the purchasing power of your money is decreasing.

If your additional income in one year corresponds exactly to the inflation rate, then your nominal income and your real income are identical. Nevertheless, your tax burden will increase as a result of the progressive income tax rate.

Although it may seem this way at first glance: If your income increases, it can never lead to your nominal net income being lower after tax deduction despite cold progression – even if your income tax rate increases. However, the tax burden on your real income may increase. This happens when the inflation rate is higher than your increasing income.

Cold progression in a broader sense

Cold progression in a broader sense is what the public calls a secret tax increase. The increase in prices is disregarded and only the increase of a taxpayer’s income is considered. If incomes rise, the tax burden on citizens rises. The state’s tax revenues are rising. The reason for this is the progressive tax rate in the UK, which taxes higher earners more heavily. The state can only prevent this type of cold progression by reducing the tax burden in response to increases in income (e.g. by increasing the basic allowance and/or reducing the tariff curves). Whether and how this kind of cold progression should be avoided by the state is often discussed by experts.

Normal progression vs. cold progression: Explanation

In addition to cold progression, there is also so-called “normal progression.” This, as explained earlier, actually refers to the progressive income tax rate. The fact that the two are often portrayed as opposites is due to the different outcomes. Normal progression is deliberately designed in such a way that higher earners are burdened more heavily – among other things – in order to avoid extreme income differences in society.

Cold progression, on the other hand, affects people with lower and middle incomes in particular. This group of people is more heavily burdened by income increases that are not supported by decreasing income tax. If you look at the development of cold progression over a longer time, it becomes apparent that the tax burden on low-income earners is increasingly aligned with that of higher-income earners. This again contradicts the actual concept of normal progression.

Calculating cold progression with an example

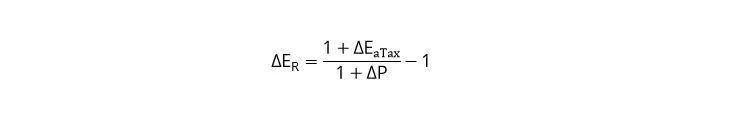

The effects of cold progression can be calculated using a formula. This is always based on change values – i.e. not on absolute income, but on a change in income.

ΔER = Relative change in real income

ΔEaTax = Relative change in income after taxes are deducted

ΔP = Relative price change

Since these are changes over time, two different points in time must be analysed.

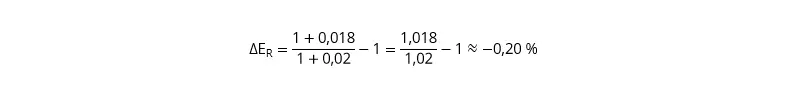

Example: We assume that an entrepreneur makes an annual income of £60,000 in year 1. In year 2, they increase their own prices by 2% in order to offset the general price increase of 2%. In the course of year 2, the entrepreneur makes an income of £61,200 and has thus compensated for inflation – albeit before deduction of taxes. Due to the increase in income, they are now also subject to a higher income tax rate – 28.15% instead of 28.01%. At the end of the day, the entrepreneur only has an increase of about 1.8% after tax – from £43,195 to £43,972. If the price increase is taken into account, the result is even worse:

Real income is about 0.2% lower than in the previous year. If the entrepreneur had not increased their income, they would even have to reckon with a decrease in real income of around 2%. Looking at several years, the cold progression in the narrower sense with an annual price increase of 2% develops as follows – provided that the salary increases as prices rise:

| Year | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Annual income (before taxes) | £57,624 | £58,800 | £60,000 | £61,200 | £62,424 |

| Average burden with income tax | 27.70% | 27.95% | 28.01% | 28.15% | 28.19% |

| Income tax | £15,963 | £16,434 | £16,805 | £17,228 | £17,596 |

| Annual income (after taxes) | £41,661 | £42,366 | £43,195 | £43,972 | £44,828 |

| Change in income (after taxes) | +1.69% | +1.96% | +1.80% | +1.95% | |

| Price change | +2% | +2% | +2% | +2% | +2% |

| Change in real income | -0.31% | -0.04% | -0.20% | -0.05% |

The annual increase in the average burden on entrepreneurs shows how severely they are affected by cold progression in the broader sense. In line with the principle of efficiency, the increase in income also means that it is subject to a much heavier tax burden.

Effects of cold progression

Cold progression has had a considerable influence on tax revenue in countries such as the US, especially in the last few years. If the state does not regulate the tax system, more taxes will be paid than actually planned. Finally, those income increases that are only intended to compensate for losses through inflation will also be taxed more heavily.

The term “secret tax increase” stems from the fact that the state does not need to amend any legislation in order to do so. Critics therefore criticise the fact that this form of tax increase is beyond the control of any government.

In some countries, low wage-earners can find themselves paying higher taxes if targeted tax concessions such as employment-conditional benefits or tax credits are not adjusted to take inflation into account. Where tax reliefs like these exist, cold progression can erode their value, and particularly affect low-wage earners.

It is discussed time and time again how and whether the effects of cold progression should be tackled at all. However, a systematic approach against cold progression has not yet been adopted. To prevent cold progression, an adjustment mechanism could be set up linking the increase in the income tax rate to the price increase. The tax amount would then automatically adjust to inflation.

Another solution – at least theoretically – could be to abolish normal progression. With a uniform tax rate there can be no cold progression, because there is no higher tax rate into which one could slip. Everyone would have to give up the same percentage of their income – regardless of their income level. However, this method is considered anti-social and therefore hardly ever considered.

Please note the legal disclaimer relating to this article.