Cash flow accounting: Cash flow statements easily explained

Cash flow statements are an accounting procedure in which the inflow and outflow of cash are clearly mapped out. The main focus is the question of how a company’s finances have changed over the course of a year. The statement aims to provide a transparent presentation of all the funds accumulated by a company as well as how they’re used. The cash flow statement provides information on how prepared a company is to generate surpluses, meet payment obligations, and make distributions to shareholders. In short, cash flow accounting is a method of analyzing changes in cash and cash equivalents during a period of time.

The finances of companies are defined as the stock of its cash and cash equivalents. Cash includes all paper cash as well as bank deposits that the company can access at any time (demand deposits). Cash equivalents include short-term, highly liquid financial investments that are readily convertible to a known amount of cash, and are only subject to insignificant value fluctuation risks.

Term clarification: Cash flow statement

Strictly speaking, the term “cash flow statement” is misleading—in addition to financial data, a company’s capital usually also includes tangible assets like machinery, technical equipment, land, buildings, operational equipment, and vehicles, which can’t be quickly liquidated and are considered long-term assets. But the cash flow statement only represents the inflow and outflow of a company’s cash finances, meaning the changes of liquid cash and cash equivalents during a period of time and their causes.

Cash flow statement: Option or obligation?

A cash flow statement is required by the UK Financial Reporting Council (FRC) as one of the disclosed quarterly financial reports for publicly traded companies. The statement of cash flows is also required whenever a business makes an income report, a rule set under the UK GAAP (Generally Accepted Accounting Practice), also published by the FRC. The International Accounting Standard 7 (IAS 7), issued in 1992, is the current standard for cash flow statement regulation. This statement differs from an income statement included in an annual report, as it only tracks cash, not contracts that count as revenue or other forms of potential profit. Managing cash flow accurately is crucial for analysis of a company, and is in the best interest of investors and analysts. Cash flow statements are the best way to judge a company’s short-term viability, making them particularly crucial for small businesses or businesses that rely on investors with confidence in their ability to pay bills. It’s recommended for any business to analyse cash flow at least once per quarter. Even companies that appear to be profitable can go under if they don’t actually have enough cash on hand to pay the bills.

Presentation of information in a statement of cash flows

The FRC, as the authority regarding accounting standards, added the disclosure of funding sources and uses to the Generally Accepted Accounting Principles (UK GAAP) and detailed cash flow requirements in section FRS 102, but the specific regulations regarding the presentation of information in a cash flow statement come from the IAS 7.

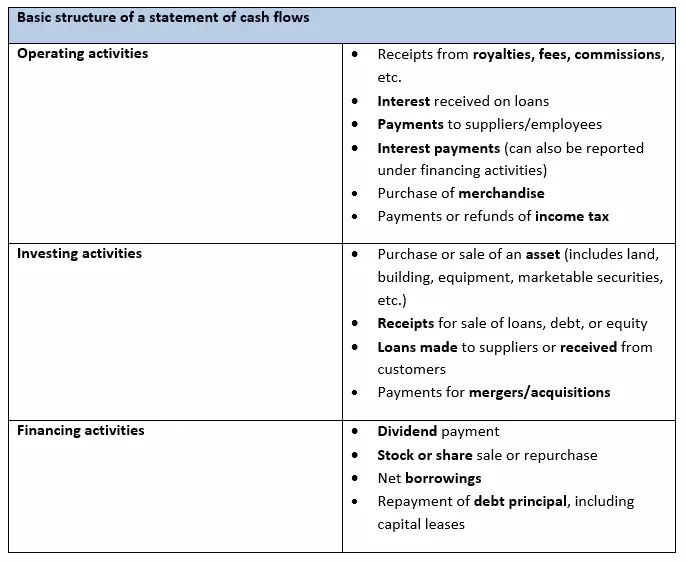

Statements of cash flows are broken down into three different sections:

- Cash from financing

- Cash from operations

- Cash from investments

These sections are followed by a general statement of the net increase or decrease in cash.

Preparation of the statement can happen in one of two ways, which vary only in how they present the operational section: the direct method, which is encouraged by the FRC, and the indirect method. The direct method, also referred to as the income statement method, starts with cash received and then subtracts spent cash via reports of operating receipts and payments. The indirect method, on the other hand, starts with net income, adds the depreciation back in, and then calculates changes via a balance sheet. Both methods eventually yield the same results.

As cash flow is calculated, depreciation values are left out of the statement. Any expected revenues that have not yet been received are also not included. Below is table detailing the basic structure of a cash flow statement template, as defined by the internationally recognized standard IAS 7:

IAS 7 doesn’t explicitly recommend or stress the relevance of including figures from the previous period along with your current report, but the objective, which states the “presentation of information about the historical changes in cash and cash equivalents of an entity”, could be seen as an endorsement.

Supplementary information on the cash flow statement

As a condensed version of cash flow, a statement of cash flows is intended to provide a comprehensive overview of the financial situation of a company for quarterly or annual financial statements. To help facilitate the interpretation of the document, ASC 230 provides for a number of additions and declarations to be included in the notes as mandatory disclosures.

- Information on the composition of the finances

- Calculated reconciliation of the cash and cash equivalents from the corresponding balance sheet

- Cash and cash equivalents held by the company but not available for use

- Separate information on cash flows related to the acquisition or sale of subsidiaries

Quarterly or annual financial statements also need to contain the following information, provided it hasn’t already been included:

- Separate statement of cash flows from received and paid interest and dividends

- Separate statement of cash flow from income tax

Non-cash activities may also be disclosed in the footnotes, including such activities as:

- Leasing to purchase an asset

- Converting debt to equity

- Exchanging non-cash assets or liabilities for other non-cash assets or liabilities

- Issuing shares

- Payment of dividend taxes in exchange for assets

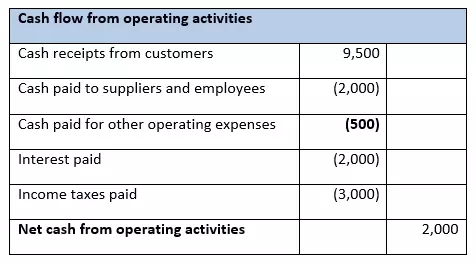

A cash flow statement made using the direct method might look like the following example:

Increases in cash are generally listed normally, while decreases are written in (parentheses).

Please note the legal disclaimer relating to this article.