What are guarantors?

Put simply, in non-technical language: A guarantor is a third party who signs to “support” someone signing a contract on renting a flat, for example. “Support” is offered to both parties signing the contract – so, for example, if a student signs a rent contract, and for some reason can’t pay their rent, they and the lessor can be reassured that the guarantor can jump in to pay the rent instead. Guarantors can come into effect in many business environments, such as for bank loans, or rent contracts, for example. This article will look closer at the complexities of being a guarantor and what a guarantee is.

Definition of a guarantee made by a guarantor

To expand on the basic introduction above, here is a more technical definition, to introduce some of the terms you may come across:

A guarantor is an individual person or firm who approves a three-party-contract to ensure (or guarantee) that the first party (the principal debtor) keeps their promises to the second party and takes on liability if the first party fails to keep these promises. In case of a default (when the guarantor has to step in), the guarantor must compensate the second party for the amount stated in the contract.

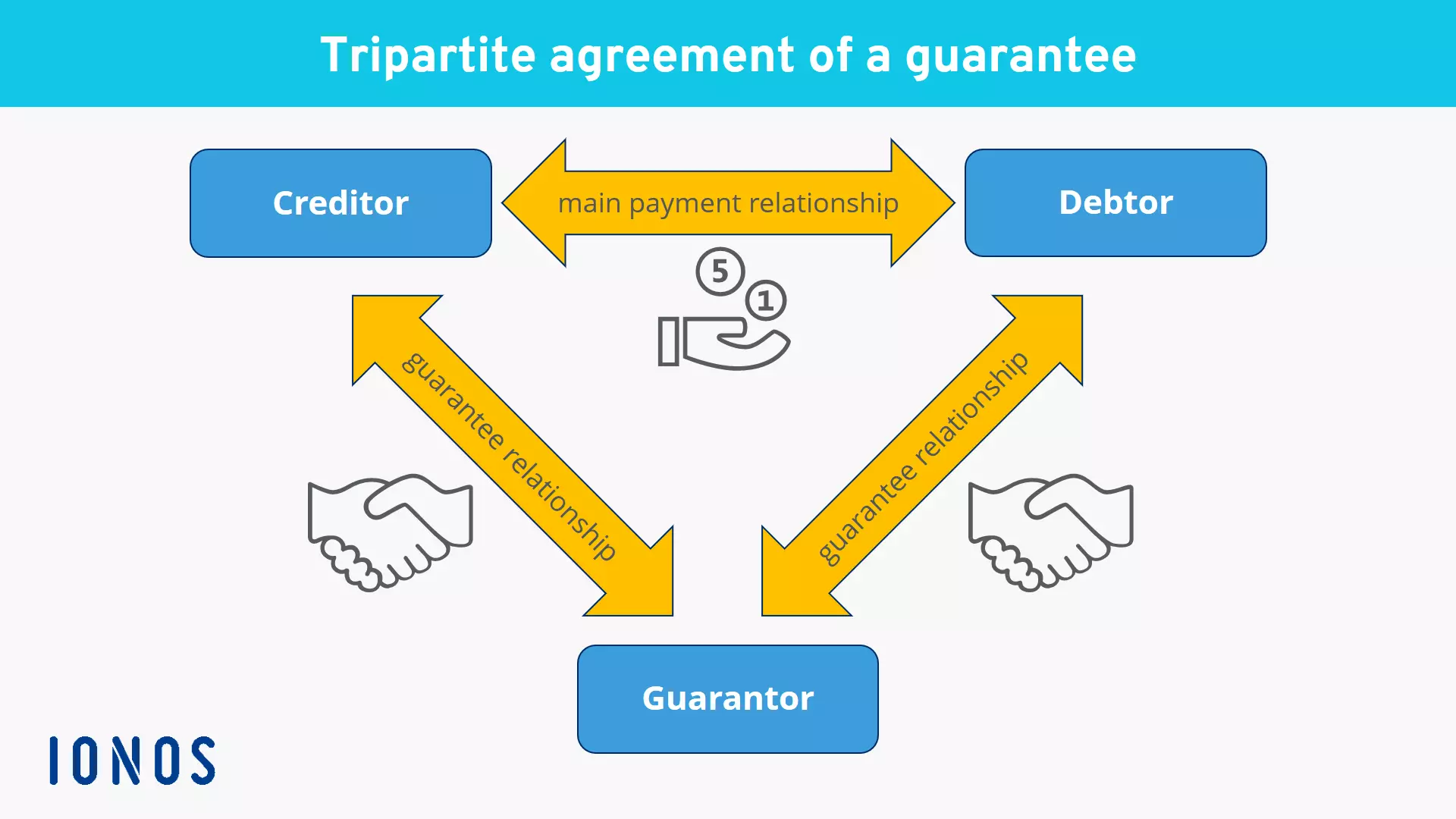

Three-party agreement (tripartite agreement)

Each guarantee is in principle a three-party-agreement guarantee. The three parties are the guarantor, the creditor, and the debtor in relation to the creditor, called the principal debtor. This connection can be illustrated in this way:

How does a guarantee work?

A transaction concluded between two parties does not necessarily require a guarantor. However, if one of the two parties first provides a service (grants a loan, rents an apartment, etc.) and demands a guarantee from a third party to secure the consideration, a guarantor is usually required. This must first be accepted by the contractual partner who wishes to be secured by a guarantee, so not just anyone can act as a guarantor. There are various parties who can act as a guarantor: private persons, as well as businesses which offer this as a service.

Personal guarantees

In the case of a private guarantee, a private individual usually assumes a guarantee for another person close to them, such as a family member of the debtor. Anyone who accepts such an obligation under these circumstances should inform themselves thoroughly about the scope of their declaration of intent, i.e. the rights and obligations as guarantor, and should also know the financial situation of the principal debtor before signing the declaration of guarantee. Especially in families, it is easy to make a guarantee commitment for one's own children, siblings, or parents without considering the resulting legal consequences. In the worst case, this can lead to unexpected financial problems and family disputes. What are the kind of guarantee?

Unlimited personal guarantee

This form of personal guarantee means that the guarantor agrees that the lender can request the full amount lent, plus legal fees from the guarantor. So, if a person cannot pay their rent, their guarantor will have to pay all of the rent, as well as any incurred costs (reminders or warning charges), for example, which the renter has not paid. In the case of a business, if a loan owed is £75,000, and the lender hires legal assistance to ascertain whether they can recall the money from the business who cannot pay their loan back, which costs £10,000, the guarantor owes £85,000. This is a high-risk form of guarantee for the guarantor, but many lending-bodies prefer it, for obvious reasons.

Limited personal guarantee

Instead of an unlimited personal guarantee, there is an option to provide a limited personal guarantee. These are usually used in business contexts. The guarantor and lender determine a set amount which can be collected by the lender, in the case that the first party cannot repay a loan, for example. So that the lender does not lose money, a limited guarantee often involves a joint guarantee with other parties. Here, it’s important to note whether the guarantor is signing a several guarantee or a joint and several guarantee. With a several guarantee, each party within the joint guarantee contract will have a percentage of liability which is determined before the signing. This means that a guarantor will be fully aware of the worst-case scenario, and how much they will have to pay if things go wrong. On the other hand, a joint and several guarantee is not as clear, as it is possible that any of the parties signing the guarantee will have to pay the amount in full. The lending party will be able to recover what they lent in full, and they can do this by demanding the full amount from any of the guarantors who sign the joint and several guarantee. This option is an option which most lenders will find appealing.

What are the requirements for a private guarantee?

In principle, any adult with the capacity to contract can act as guarantor. To do this, they must of course be sufficiently financially well off, otherwise they won’t provide any added security for the party providing the loan or lease. There are some more specific requirements too, which will be covered in the following.

The requirements for being a guarantor for a private guarantee is as follows:

- Proof of residence at the given address

- Their income must be verified to be sufficient to cover the monthly payments

- Guarantors must be UK residents

- A guarantor must have a traceable UK credit history

- A guarantor should be able to show they have valid identification

There isn’t a determined income for specific repayment amounts; this changes depending on the field in which the repayments are being made. The requirements for each contract need to be known before suggesting a guarantor, or offering to be one. Serious applications should normally be above the minimum requirements.

As a student or young person it may be unlikely that you know someone with this income, so getting a private person to be your guarantor isn’t always an option. Instead, you may be able to hire a guarantor, although this will cost money. Because of this it may be more appealing simply to look for the right landlord, who is more understanding of your situation: maybe a tough path to choose in cities with a competitive rental market, but a safer option in more relaxed cities.

What is important in a guarantee?

Guarantees are legal documents, and as such they need to be drawn up rigorously. Some guarantees can be withdrawn; it all depends on the wording. Unless a guarantee states explicitly that it cannot be withdrawn, that it is “irrevocable,” it may be withdrawn at any time. Paying attention to this detail is of high importance. Personal guarantees, even guarantees which are apparently limited guarantees, are often intentionally vaguely worded. This may end up with you as a borrower having to account for provisions and requirements which you wouldn’t think of, and which aren’t immediately clear on first reading. This makes getting legal advice a good idea when agreeing to be a guarantor, to avoid ending up in a tricky situation.

Please note the legal disclaimer relating to this article.