Robo-Advisors

Those who want to profitably invest their money these days can find numerous online advisors, finance blogs, and YouTube channels that provide necessary background knowledge and in-depth information for a suitable investment strategy. With the robo-advisor in 2013, a new system came onto the market for the first time that would not only give individuals tips with regard to exchange-traded funds, but also take over the entire asset management process according to the user’s wishes. But how exactly does this modern type of financial management work? And which differences are there between the individual providers?

What exactly is a robo-advisor?

The term “robo-advisor” combines robot and advisor to represent a number of companies in the financial technology sector (so-called FinTech firms) that digitise the classic services of financial advisors. These special online platforms are used to help private investors put together a portfolio of investment products to be automatically monitored by algorithms and modified following developments in the financial market. The term “robo-advisor” is used both for the respective provider and the platform.

FinTechs are companies that are altering the financial services sector through innovative technology. The term “FinTech” combines the words “financial services” and “technology,” and is also used as a general term for modern technologies in the financial sector.

How does a robo-advisor work?

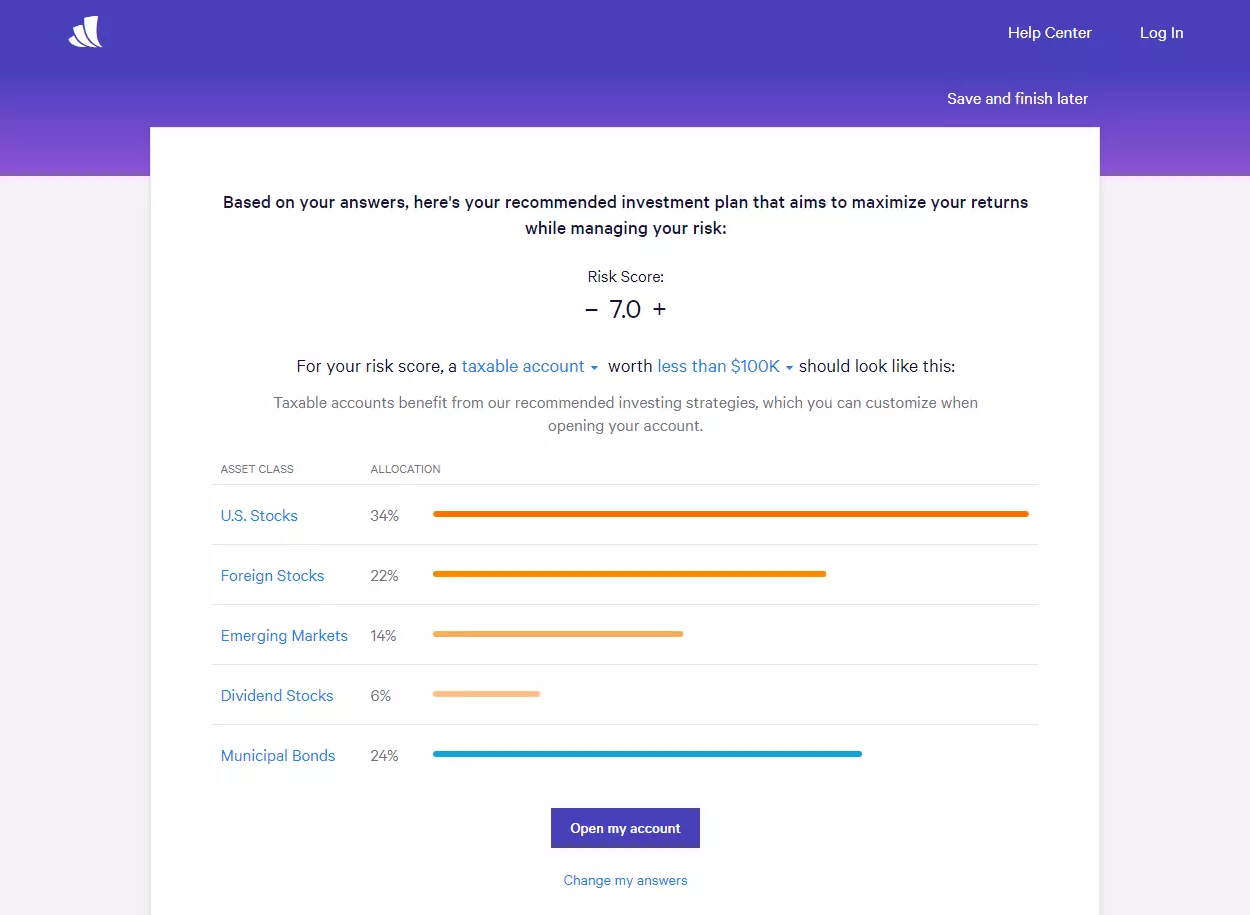

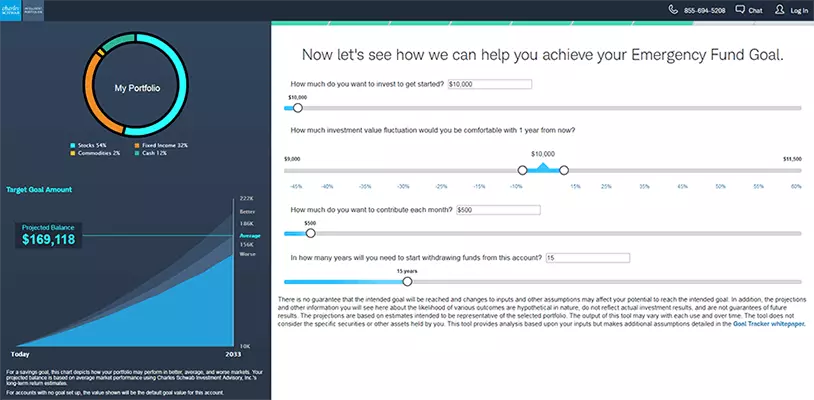

Private investors enter information on the selected robo-advisor’s website about their current financial situation as well as goals and ideas in regard to investment. The investor’s willingness to take risks plays a big role here. The robo-advisor can only gather the right investment products for the customer’s portfolio once it knows these things exactly.

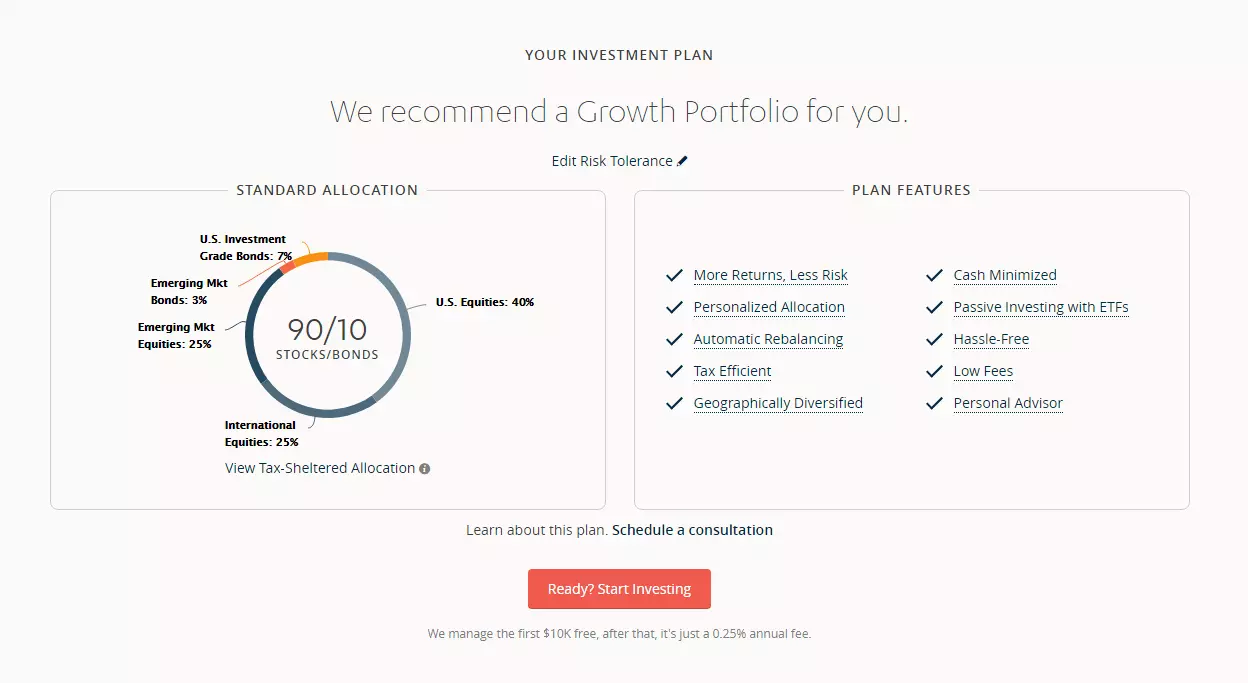

The more willing the investor is to take risks and the longer they want to invest their assets, the more securities from high-risk sectors will be added to the client’s portfolio by the robo-advisor. Based on personal details, an individual investment strategy will then be created – as a type of package, made up of various finance products. With many providers, the risk level can also be increased or reduced afterward.

To put together a suitable investment strategy, a robo-advisor generally uses statistics and key financial figures. These are automatically compared with the investor’s given goals and securities for the portfolio are selected accordingly. According to the style of the robo-advisor (see below), it will not only suggest suitable strategies, but also manage the entire investment process. It decides in which industries and regions of the world to invest, and which bonds or stocks to purchase. The technology behind it varies based on the provider.

The investment portfolio is based on exchange-traded index funds, also known as ETF (exchange traded funds). These are funds that replicate an index (for example the DAX, MSCI World Index, or Euro Stoxx) – and so are managed passively. The robo-advisor combines these with classic actively managed funds, such as those of the American asset manager Dimensional. How the ratio of the two different types of funds ends up in the portfolio is calculated independently by the robo-advisor based on algorithms. The goal is create the optimal mix of opportunities and risks.

PHENPHAYOMshutterstock

PHENPHAYOMshutterstockWith active management, investment decisions are left to a professional fund manager. They decide which securities to buy to achieve the highest possible return for the investor. Passively managed investment funds, on the other hand, deal with index funds where the index (e.g. the German stock index DAX) determines the composition of the investment portfolio. The index is simulated by computer control for this purpose.

Occasionally, the robo-advisor will also automatically take over the rebalancing of investments. It’s not uncommon for the portfolio to change, for example, due to fluctuations in the value of individual positions, i.e. funds deviating from the original strategy. Positions whose values have greatly increased over time then have to be sold proportionately. Positions that have lost value, on the other hand, have to be purchased proportionately. In this way, the original risk-return profile is restored according to the desired investment strategy. The robo-advisor brings the portfolio back into the correct balance.

What types of robo-advisors are there?

The algorithmic asset management offers various benefits. Which features individual private investors profit from depends on which type of robo-advisor they use. A distinction is made between full-service, half-service, and self-service systems.

Full-service robo-advisor

The full-service robo-advisor takes cares of all aspects of the financial investment. It suggests an investment strategy to the investor, takes over the complete asset management, and independently takes care of the rebalancing to restore the original investment structure, if necessary. Serious full-service robo-advisors are generally registered as investment advisors with state securities authorities or federally with the SEC, and are required to adhere to all of the same security laws levied on all registered advisors. This allows the robo-advisor to manage your assets in much the same way as a human advisor would.

Half-service robo-advisor

As the name suggests, this robo-advisor offers a limited service. It acts as a broker for its customers, procuring investment products as part of an investment strategy, but as soon as the investment structure has to be adjusted (rebalancing) it requires the approval of the customer. So if you use a half-service robo-advisor, you’re not entirely giving up the management of your investments.

Self-service robo-advisor

The self-service robo-advisor can be regarded as a kind of guide. It only gives the investor tips on the topic of financial investment. The investor has to do all of the asset management (opening securities accounts, purchases, sales, rebalancing) on their own.

Who is asset investment via robo-advisor suitable for?

In principle, a robo-advisor is suitable for anyone who wants to logically invest money for the long-term and needs professional support for their investment decisions. If you want to use virtual asset management, you should have some background knowledge on the topic of funds so that you can better evaluate the investment proposals. Compared to self-administered management, though, investors don’t have to spend as much energy dealing with individual scenarios and the follow-up decisions themselves. A full-service robo-advisor decides for itself what’s best for the investment structure, and automatically carries out rebalancing during the entire investment period.

If you want to make a profit in the capital market, you should make long-term investments. The same goes for investors that use a robo-advisor and algorithmic investment strategies. For example, if you want to invest your yearly bonus for one year only, then you would be better off considering other alternatives. A robo-advisor is primarily suitable for long-term asset building.

Automated asset management is suitable, though, for those who tend to make emotional decisions when investing money. In the event of price fluctuations, for example, shares are often sold off too quickly for fear of losses. Computer programs, on the other hand, make decisions on the basis of key figures without any emotions and offer dynamic risk management at the same time to stabilise the investment strategy.

Who are robo-advisors not suitable for?

Robo-advisors shouldn’t be the first choice for investors with short-term investment goals. Even though the portfolio can be terminated at any time, and the invested assets will be released, the risk of a loss of value could also increase, since there’s no longer extra time for it to be compensated. Compared to a robo-advisor, a classic financial advisor can much better meet the needs of investors who want to invest in the short-term, and can develop the optimal investment strategy according to their individual ideas.

Speculative investors, as well, are not well advised by the virtual asset management. These are people who prefer to invest money in the short-term and at high risk. Of course, the robo-advisor can’t work without any willingness to take risks – after all, the compiled portfolio includes funds that are subject to fluctuations in value. These can’t always be reliably foreseen by algorithms.

A robo-advisor is suitable for all private investors who want to invest money in the long-term and have a certain minimum willingness to take risks. But users of the corresponding platforms should still have basic knowledge of the capital market, particularly if they decide on a half-service or self-service robo-advisor.

What financial knowledge should an investor have?

You don’t have to be an expert in financial investment, ETFs, or capital markets to be able to use a robo-advisor. However, you should have a working understanding of how exchange-traded index funds and your own portfolio are put together.

It’s important to note that ETFs don’t necessarily have to be index funds. Since most ETFs are, though, the terms are usually used synonymously. Index funds are modeled on a certain market index, 1:1 if possible. Take, for example, the popular market index DAX, which contains the 30 largest German stock corporations. To understand the precise value development, the ETF must create an exact image of the DAX – each individual share has to be weighted as it’s found in the DAX. This way, as the DAX develops so does the ETF.

Investing in ETFs also gives small investors the opportunity to invest in a broad range of markets and operate systematic asset formation. Because index funds are passively managed, the costs as well as the required effort are comparatively low.

How expensive is investing with a robo-advisor?

Due to its passive management (in the case of most providers), a robo-advisor is considered a comparatively low-cost option for asset management. The overall cost for the investor, however, depends on the range of service (full- or half-service) as well as the respective provider.

Some providers charge a yearly management fee calculated depending on the investor’s fixed assets. Others focus on the average volume per year – the fee is the calculated monthly, quarterly, or yearly. Since the fees vary strongly between providers, a thorough comparison of robo-advisors beforehand is indispensable. You can find a direct cost comparison of the five most popular providers in the US at the end of the article.

How safe is investing with a robo-advisor?

How secure investing over an online platform is depends not least on the provider and the technology in use. A reputable robo-advisor will only send customer data via encrypted transmission and will never request a transfer of the desired investment amount to the company account. Instead, a reference account is opened for the customer to securely manage all payment flows. This is an effort by the provider to protect the investor’s assets from unauthorized access.

To be certain that the provider themselves can’t gain access to the assets, you should choose a robo-advisor that is directly scrutinized by the SEC and so meets the obligations set forth for advisors – which is usually the case with reputable full-service platforms.

Since robo-advisor’s make up a very small proportion of the UK investing market, the field has so far been largely untouched by major banking institutions. However, some major banks such as Santander and HSBC have expressed an interest and will be rolling out robo-advice outlets in their branches. Whilst the upside of using a robo-advisor is avoiding the high fees charged by banks and financial institutions, being backed by a major bank does go a bit further to guaranteeing your money. However, the risk of suffering losses from an investment with a robo-advisor can never be completely excluded. This can be classified as rather low, though, due to broad diversification – depending on the investor’s willingness to take risks.

A comparison of the best robo-advisors

Various comparison portals (such as RoboAdvisors, which looks at the merits of various robo-advisors), online platforms (such as Advisory HQ), and financial magazines (such as MoneySense, which reports on the latest developments in financial planning) regularly examine providers of digital asset management. The robo-advisor comparisons show how the offers differ in terms of minimum investment, fees, and portfolio composition. We’ve clearly compiled the most important facts for five of the most popular providers in the UK for you here.

| Provider | Moneyfarm | Moola | Nutmeg | Scalable Capital | Wealth Horizon |

| Portfolio composition | ETFs (up to 9 asset classes | EFT’s | ETFs | ETFs | ETFs (up to 10 asset classes) |

| Minimum investment | No minimum (no investment until the balance is £100) | £50 | Initial investment of £500, rising to £5,000 over time | £10,000 | £1000 |

| Annual fees | 0.7% management fee 0.3% expense ratio | 0.75% of your investment amount per year | 0.75% up to £100k, 0.35% beyond for a fully managed portfolio 0.45% up to £100k, 0.25% beyond for fixed allocation portfolio | 0.75% management fee 0.25% average expense ratio | 0.25% on investments 0.5% for financial advice 0.25 for platform fees 0.18 fund charge |

| Rebalancing | Yes | Yes, quarterly | Automatic rebalancing | Yes | Yes |

| Special features | Personalised sign-up procedure | Uses precision investing | Choose between fully managed portfolio and fixed allocation portfolio | Innovative investment software | Offers personal advice and ongoing human support |