What is a SWOT analysis?

The “analysis of strengths, weaknesses, opportunities, and threats” – SWOT for short – is an instrument of strategic management. Companies rely on SWOT to determine their own position among the competition and develop a business strategy. This is referred to as positional analysis.

With SWOT analysis, external, market-related opportunities and risks are compared with the company’s internal strengths and weaknesses. The goal is to provide strategic guidance for the business plan.

A SWOT analysis unfolds in three steps:

- Creation of a risk-reward catalog (environmental analysis)

- Creation of a strength-weakness profile (company analysis)

- Combination of environmental and company analyses (SWOT matrix)

Each step of the SWOT analysis is based on detailed examinations, for which marketing experts have developed various approaches. In the following, we present the most popular models and methods for internal and external company analysis, and show how to create a SWOT matrix based on the gathered information. These serve as the basis for the strategic alignment of your company or individual areas of business.

Step 1: environmental analysis

In the first step of a SWOT analysis, businesses perform an environmental analysis: The organisation’s surroundings are examined from a strategic point of view.

Every company is part of a branch. The branch is, in turn, integrated into an environment that has a direct impact on the company through political, economic, technological, social, and ecological developments. The goal of the environmental analysis is to determine all relevant opportunities and risks that result from environmental factors and could have an influence on the company’s success.

To make the complex environment of a company tangible for analytical purposes, economists have developed various models for classifying environmental conditions into concrete categories. Some of the most popular environmental models are the three-environment model by Tony Stapleton and Kotler’s four-environment levels.

Tony Stapleton divides the environment of a company into three areas. The basis of the classification is the question of to what extent the environmental factors of a company control or influence it.

| Three-environment model (by Stapleton) | |

| Internal environment | The internal environment of a company includes all factors that are directly controlled by the management of the company: for example, employees, resources, buildings, machines, and facilities. |

| Near environment | The near environment of a company includes customers, suppliers, and the company’s direct competition – as well as factors that are not directly controlled, but can be highly influential. |

| Far environment | Factors that are neither controlled by the company nor can be influenced by it are part of the “far environment”, according to Stapleton. This includes sociocultural, technological, economical, and political environmental factors. |

The model from Philip Kotler is comprised of four levels, and classifies influencing factors from a marketing standpoint.

| Four-environment levels (by Kotler) | |

| Function environment | The task-based environment includes all functions that relate directly to the company’s performance. Counted among these are the most important company stakeholders such as owners, investors, employees, customers, and suppliers. |

| Competition environment | The competition-based environment entraps all factors which relate to the competition in procurement and sales markets. |

| Publicity | The third environment level according to Kotler consists of supervisory organisations, the press, and the general public. |

| Macro environment | Kolter’s macro environment corresponds to the “far environment” of the three-environment model. |

Which model is used for the environmental analysis is left to each analyst to decide according to the need and purpose of the analysis.

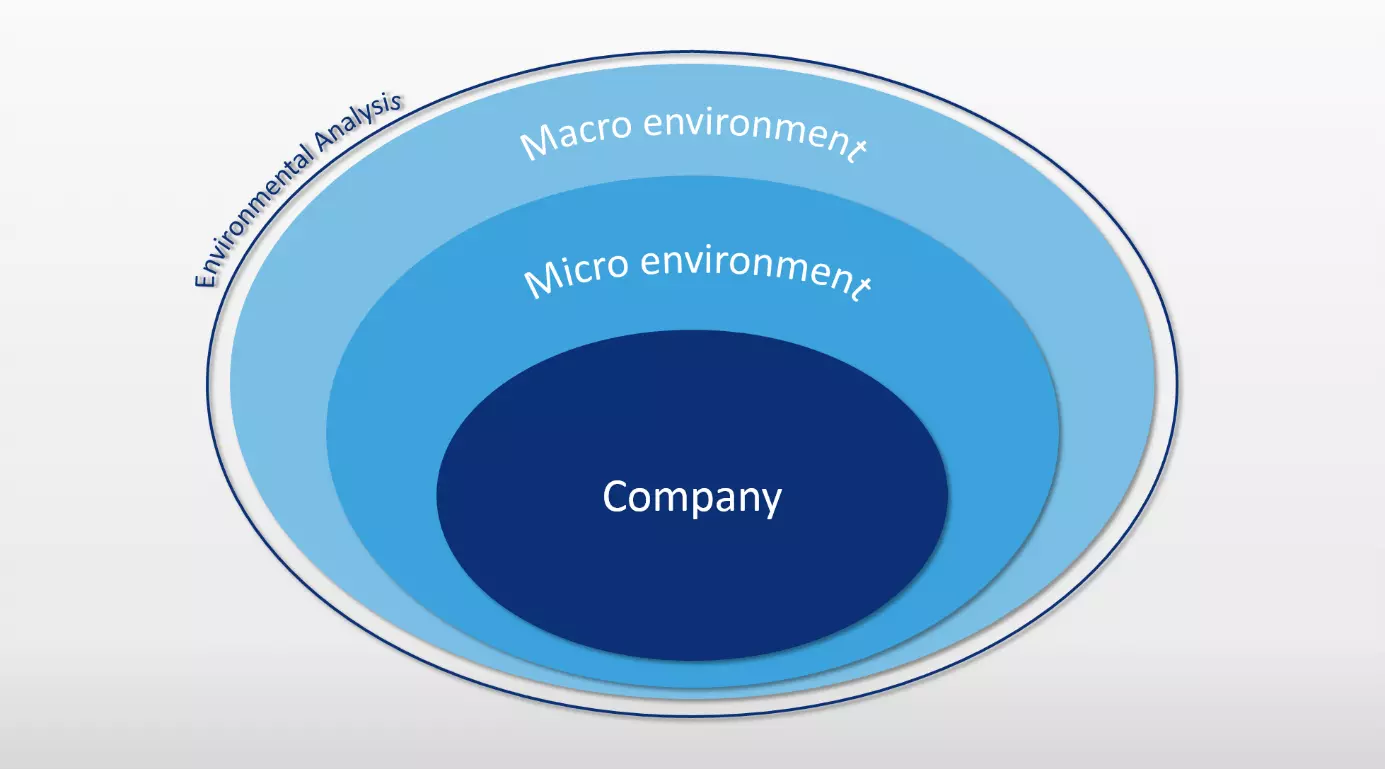

Despite differences in structure, both models presented here exhibit similarities in important areas: The initial stages distinguish environmental factors that are directly related to company activities from external factors that can’t be influenced by the company. The difference between the micro environment and macro environment is central to strategic marketing. Environmental analyses are thus often limited to these levels.

The micro environment consists of a company’s industry, including all stakeholders. It’s different from the macro environment mainly in that it can influenced using relationship management with relevant stakeholders, and so can be controlled to a certain degree.

The most important instruments for analysing the micro environment are:

- The stakeholder analysis and

- The industry structure analysis

For analysing a company’s macro environment, the PESTEL analysis, which will be discussed in more detail later, has established itself particularly well.

The results of the environmental analysis are generally integrated into the SWOT analysis in the form of a risk-reward catalog.

The following marketing instruments are merely a selection of relevant analysis schemes. Analysts obtain further input for the SWOT analysis through portfolio analysis, the experience curve concept, GAP analyses, the PIMS program, or a product market matrix.

The stakeholder analysis

The stakeholder analysis is a form of environment analysis that focuses on the micro environment of a company, concentrating on the stakeholders and their relationship with the company.

In the first step of the stakeholder analysis, all relevant groups are determined and their interests described. Differentiation is also made between internal and external stakeholders.

The following overview shows a selection of relevant stakeholder groups in the SME sector as well as their demands on the company and possible contributions to its success.

| Internal stakeholders: | Claims on the company | Contribution to company success |

| Proprietor | - Appreciation of capital | - Proprietary capital |

| Manager | - Good compensation - Prestige - Influence | - Planning work |

| Employee | - Decent compensation - Comfortable working conditions - Job security - Advancement opportunities | - Accomplishing work |

| External stakeholders: | Claims on the company | Contribution to company success |

| Suppliers (vendors) | - Purchase security - Reliable payment behavior - Long-term contracts | - Supply of raw materials |

| Customers | - Good price-performance ratio - Satisfactory service | - Purchase of goods |

| Foreign investors | - Financial standing - Capital service capability - Secure financial investment - Reasonable interest rate - Scheduled repayment of credit | - Foreign capital |

| Competition | - Compliance with rules of competition - Double-sided profit increase | - Cooperation - Exchange of knowledge |

| Government and society | - Tax payments - Secure jobs - Social benefits - Compliance with legislation - Environmental engagement | - Legal system - Infrastructure - Subsidiaries |

Under certain circumstances, it may be necessary to subdivide important influence groups into subgroups to identify their respective interests, needs, and potentials. In the “employee” group, for example, “high potentials” – staff members with particular value for the company – can be filtered out. The “government and society” group is usually broken down into individual interest groups and bodies such as authorities, offices, professional associations, trade unions, lobbies, NGOs, the press, and the general public.

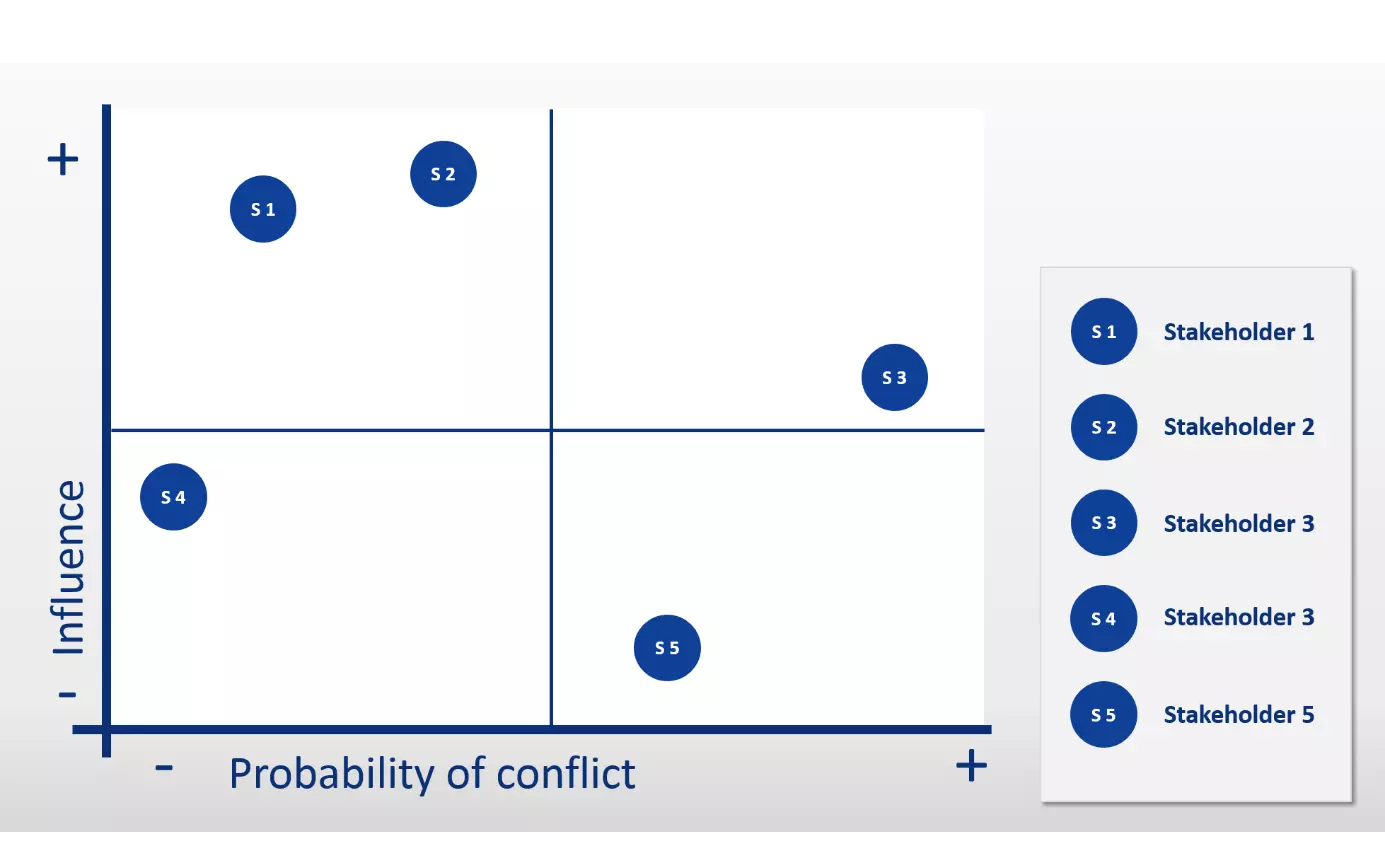

Once all relevant influence groups have been identified, it’s necessary to analyse to what extent the identified stakeholders influence or are influenced by the company. The SWOT analysis focuses mainly on the opportunities and risks that stem from these influences.

Questions to assess the opportunities offered by stakeholders:

- Which capabilities, connections, or influencing possibilities does the stakeholder offer?

- How can these be used to serve the success of the company?

Questions to evaluate the risks of stakeholders:

- Are the claims of the stakeholder in conflict to the company goals?

- Which risks are associated with conflicts of interest?

- How can these risks be reduced?

To be able to decide which course of action to take, you also need to assess how strong the respective influences of the individual stakeholders are on the company.

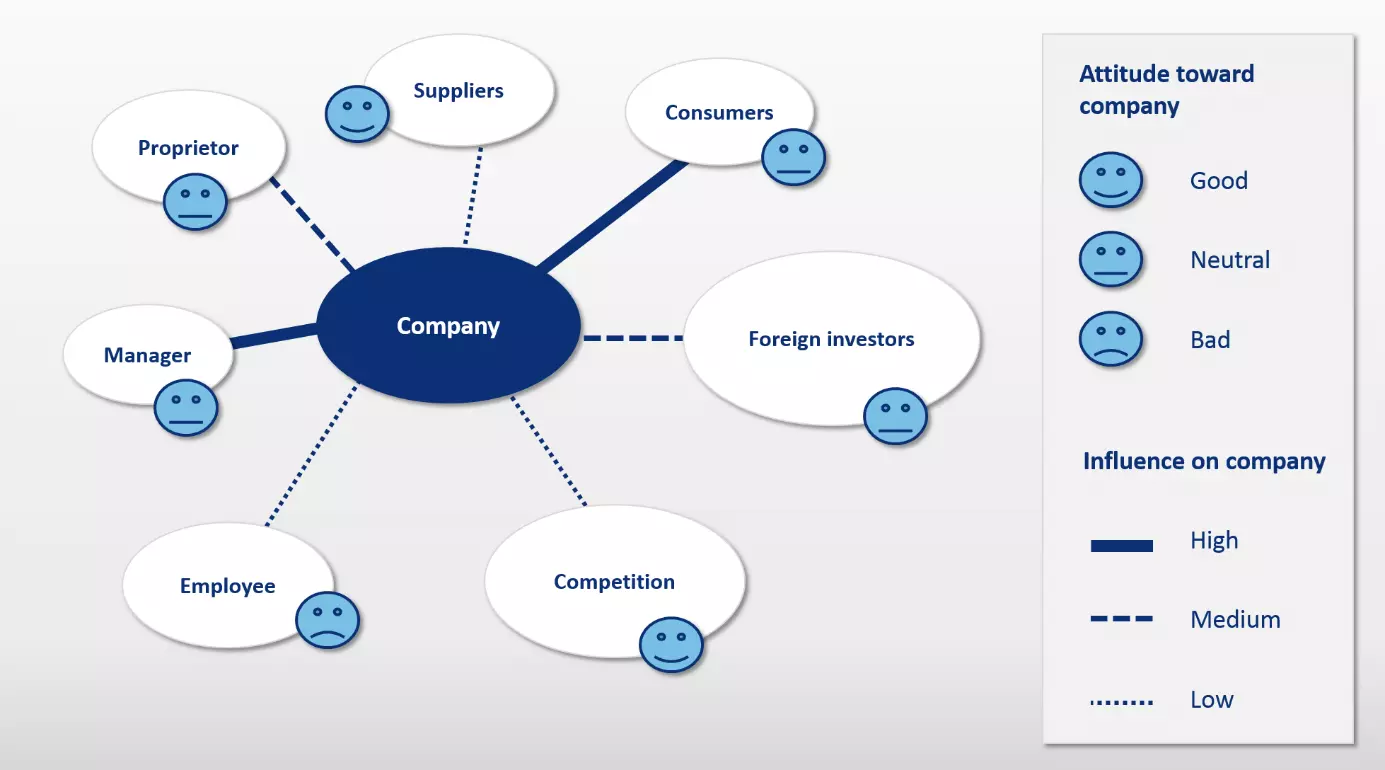

The following example shows a highly simplified graphic representation of a stakeholder analysis.

If the stakeholder analysis points out risks and opportunities that are related to the relevant groups, these are recorded in a catalog which is then included in the SWOT analysis.

The industry structure analysis

Another instrument of strategic management used for understanding the micro environment of a company is the industry structure analysis.

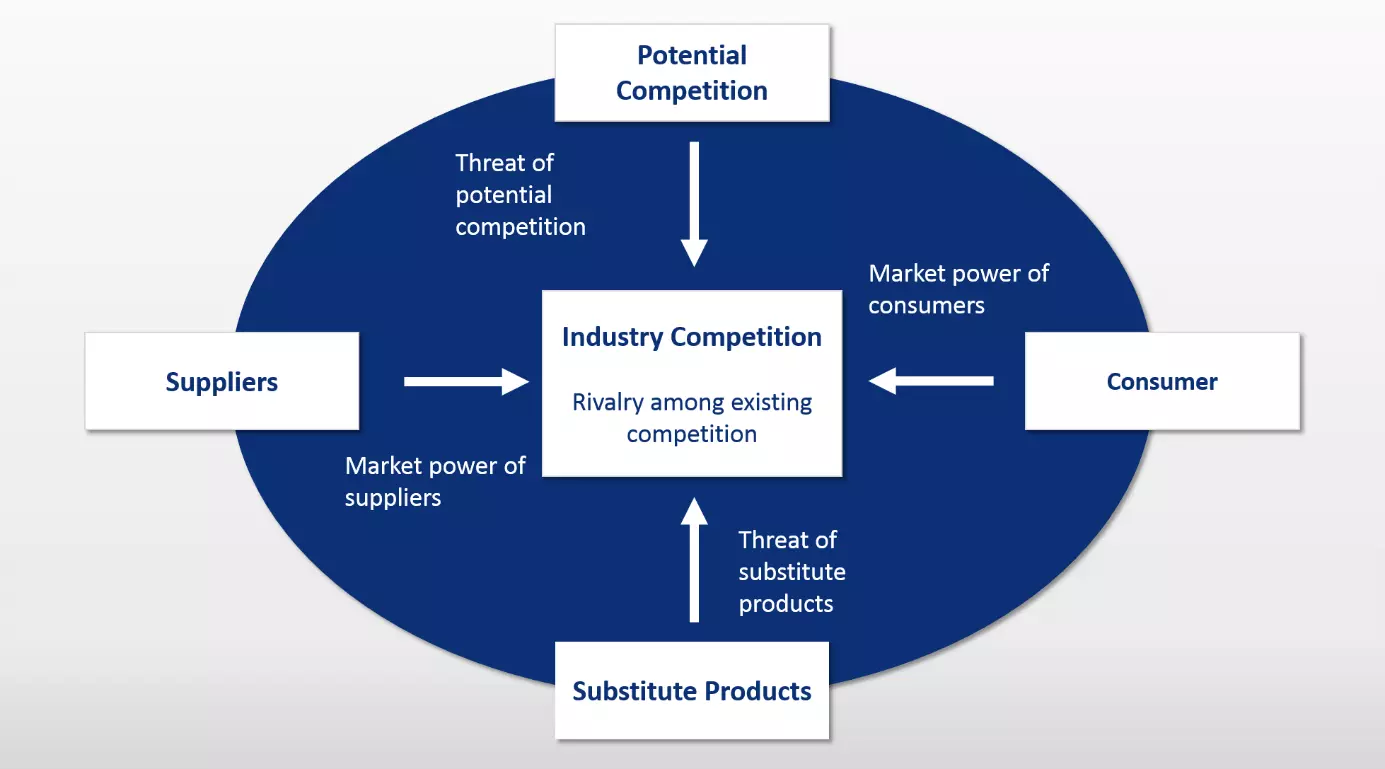

Companies use various analytical models to examine the structure of the industry and examine the competition: One popular analysis scheme is the five-force model by Michael E. Porter. The foundation of the model is the assumption that the attractiveness of a market is primarily determined by the market structure, and this has a direct influence on the market success of a company.

According to Porter, the attractiveness of an industry can be attributed to five competitive forces:

- Competition within the industry

- Threats from new competitors

- Negotiating power of suppliers

- Negotiating power of consumers

- Threats from substitute products

Each of the five forces of competition pose a danger to the company’s interests. The stronger one of these threats becomes, the less attractive the respective market is for the company.

The following graphic shows a schematic representation of the five-force model.

If the market structure changes in such a way that the threat posed by one or more competitive forces increases, then this is interpreted as a risk in the context of the environmental analysis. Similarly, changes to the market structure also open up chances for company activity. These should be identified as well, and added to the risk-reward catalog for the environmental analysis.

The PESTEL analysis

If the focus of the analysis shifts to the macro environment of a company, then a form of STEP analysis usually serves to identify environmental factors that can’t be directly influenced by company activities.

The acronym STEP (sometimes in another order: PEST) stands for sociological, technological, economic, and political change. According to the model, the macro environment of a company is mainly influenced by factors which stem from these four areas:

- Social factors

- Technological factors

- Economic factors

- Political factors

The concept of STEP was adjusted and expanded in various models. One of the most popular variants is STEEP, a model with extra emphasis on the ecological factors. If legal environmental factors are also taken account, then this is referred to as a PESTEL analysis.

The following table shows a selection of environmental factors that should be examined in the context of the PESTEL analysis. These serve to systematically identify all opportunities and risks that could have an impact on the company’s success if there are changes in the macro environment (the list isn’t exhaustive).

| Political factors | Economic factors | Social factors | Technological factors | Environmental factors | Legal factors | |

|---|---|---|---|---|---|---|

| Economic system of the country | Economic growth | Demographic structure | Government research spending | Location | General legislation | |

| Foreign policy | Population | Educational system | Technological developments | Infrastructure | Legal consciousness | |

| Stability of the political system | Interest rates | Language | Product life cycles | Availability of natural resources | Competition law | |

| Inflation rate | Values | Emission | Environmental law | |||

| Investments | Attitudes | |||||

| Exchange rates | Religion | |||||

| Unemployment | Role models | |||||

| Import/export |

The PESTEL analysis supports both primary data gathered through surveys, expert interviews, and observation, as well as from external secondary sources such as

- Official statistics

- Departmental publications

- Publications by trade associations

- Reports from economic search institutes

- Industry reports

- Publications by market research institutes

- Scientific studies

- Business reports

- Information from international organisations

Findings gained from a PESTEL analysis are also included in the risk-reward catalog of the environmental analysis, and so are available for evaluation within the framework of the SWOT analysis.

Step 2: company analysis

The second step of the SWOT analysis is the company analysis. This helps those responsible to assess the performance of the organisation. The company analysis takes place in the form of a three-step strengths and weaknesses analysis. These include:

- The creation of a resource profile

- The analysis of relevant competition

- The drafting of a strengths and weaknesses profile

Strengths and weaknesses analyses are usually not created for the company as a whole, but instead for individual planning entities. Products and services are grouped into strategic business areas. Differences in the target group orientation, competition, or production are decisive for the classification.

The resource profile

To evaluate the strengths and weaknesses of a company in comparison to the competition, it’s first necessary to determine all relevant company resources. These resources include material assets such as capital, land and property, buildings, facilities, labor, and raw materials, as well as intangible assets like technological know-how, qualifications, and brand image.

In general, company resources are divided into four areas:

- Physical resources (buildings, facilities, etc.)

- Human resources (managers, skilled workers, etc.)

- Organisational resources (information systems, etc.)

- Technological resources (research know-how, brand names, etc.)

Detailed information about the company resources is usually already available, and needs only to be compiled and prepared for the strengths and weaknesses analysis. This is based on the assumption that for each planning entity (e.g. a product, product line, or the entire company), factors can be identified that decisively influence the success of the said planning entity (so-called success criteria).

How a company is to be evaluated in regard to the relevant success criteria depends on the available resources. A comparison of the success criteria with the company resources makes it possible to identify potential and synergies. Competition-relevant strengths and weaknesses can only be deduced through comparisons to said competition, however. The company analysis always requires a competition analysis as well.

The competition analysis

Competition analysis is an examination of the most relevant competitors in a sales market. The analysis is part of the competitive intelligence, or the systematic gathering and appraising of information about competitors, competing products, market developments, industries, patents, technological developments, and customer expectations.

The competition analysis is usually carried out separately for different planning entities as well. After all, a company usually competes with different rivals in different markets. Data about market leaders and their success factors are of central importance. The analysis of the competition examines:

- Economic conditions

- Current market position

- Organisational structure

- Assortment structure

- Relationships with suppliers and customers

Information about competitor companies is not as easy to obtain as data about your own company, and so is almost always available on a smaller scale.

Analysts base the examination on primary sources such as interviews with industry experts, surveys of (former) employees, customers, suppliers, competitors’ sales assistants, trade fairs, and congresses. As secondary sources there are annual reports, publications of chambers of commerce and market research institutes available, as well as industry newspapers, patent applications, and specialist databases.

The strengths and weaknesses profile

The strengths and weaknesses profile represents the strengths and weaknesses of the company in relation to the competition. Such benchmarking makes it possible to identify specific competencies. The purpose of this is to identify competition benefits as well as drawbacks.

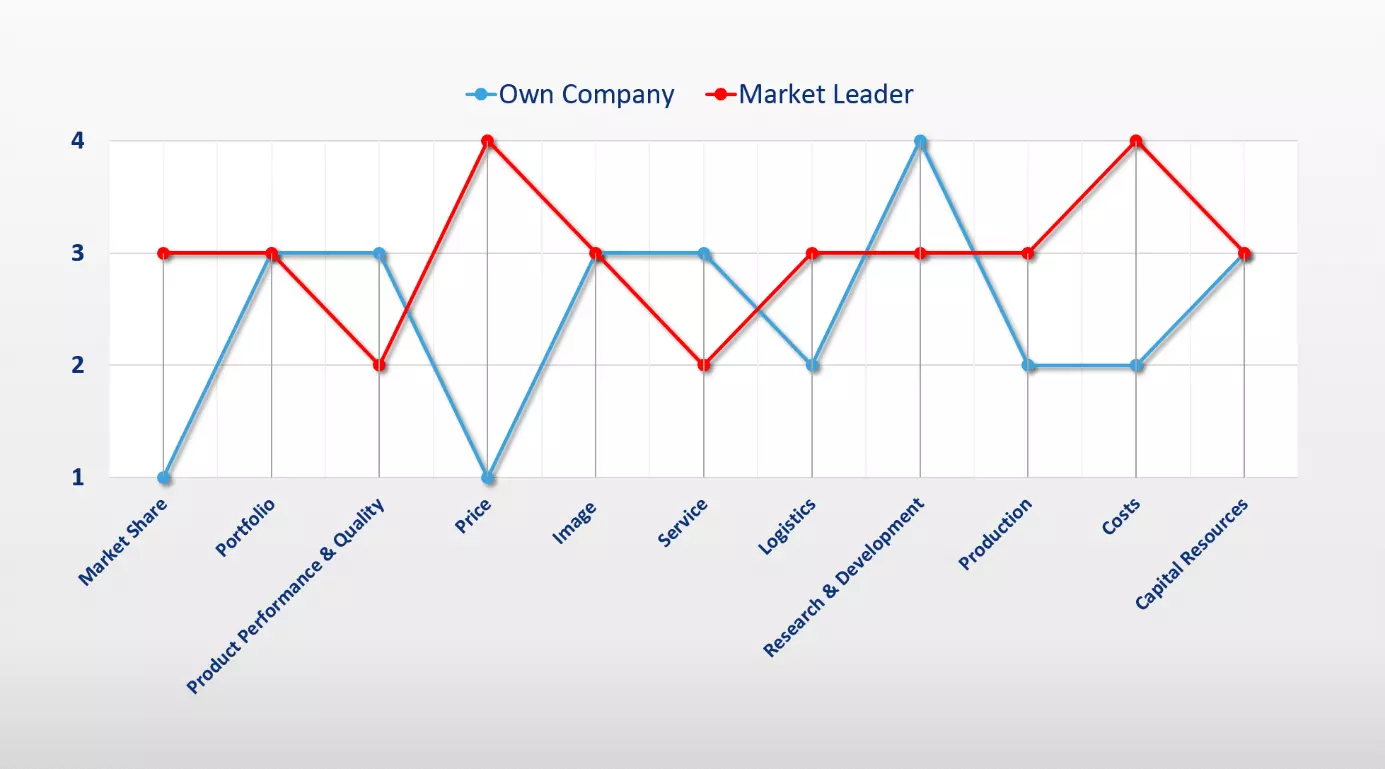

The following graphic shows an example of a simplified strengths and weaknesses profile for a strategic planning entity.

The strengths and weaknesses profile of our SWOT analysis example shows that the strengths of the examined company lay in the following areas:

- Product performance & quality

- Service

- Research & development

Compared to the market leader, deficits can also be identified in the following success factors:

- Market share

- Price

- Logistics

- Production

- Costs

This strengths and weaknesses profile of the company analysis goes together with the risk-reward catalog of the environmental analysis in the SWOT matrix.

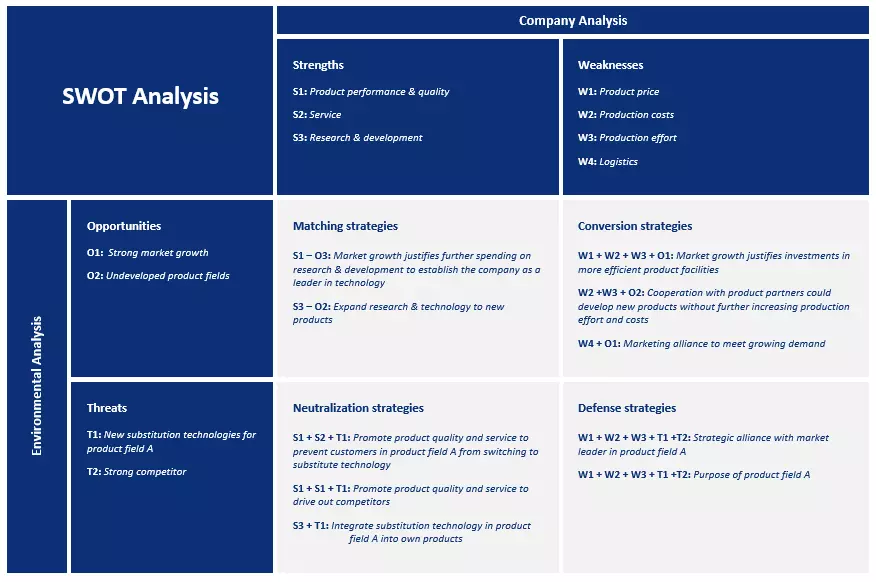

Step 3: combination of environmental and company analyses

The third step of the SWOT analysis includes a comparison of external opportunities and risks as well as the internal strengths and weaknesses. In this step of analysis, combination possibilities that deduce measures for strategic management are in the foreground. They’re differentiated by four dimensions.

- SO (Strengths – Opportunities): The combination of internal strengths with external opportunities helps companies calculate external chances with which you can use environmental opportunities for corporate success. Matching strategies can be developed in the SO dimension that can be used to grow strengths.

- ST (Strengths – Threats): A combination of internal strengths with external risks should reveal which previously existing strengths could minimise the risk of environmental threats. The goal of the ST dimension: To develop neutralisation strategies for protecting the company against risks.

- WO (Weaknesses – Opportunities): Using a comparison of internal weaknesses and external opportunities, companies try to identify weaknesses that can create opportunities for the business. The goal of dimension WO: To develop conversion strategies for strengthening the previously weak areas within the company.

- WT (Weaknesses – Threats): Through the combination of internal weaknesses and external risks, companies identify areas in which there’s an acute need for action to protect against possible damage. The goal of the WT dimension: To develop defense strategies for minimising risks and avert threats.

The results of the SWOT analysis are usually presented in a SWOT matrix. The following example is based on the previously determined strengths and weaknesses profile, as well as the assumption that the strong market growth and untapped product fields were identified as opportunities in the environmental analysis, and the new substitution technologies and strong competition identified as risks.

In our SWOT analysis example, deficiencies in product production, logistics, and pricing were identified as part of the company analysis. On the other hand, the environmental analysis has shown that the market for the product will also continue to grow. In addition, previously untapped product fields were identified. A possible strategy identified by the WO combination of the SWOT matrix is as follows:

The market is promising and expenditures in the areas of production and logistics are justifiable. The resulting increase in efficiency makes it possible to lower costs for the consumer and so reduce the price difference between the company’s products and those of the market leader. The goal of this conversion strategy would be a better positioning of the products on the market.

Similar strategies are developed on the basis of the SWOT matrix for all four dimensions.

Critical consideration of the SWOT analysis

The SWOT analysis is an established instrument of strategic marketing. Companies should be mindful though that this type of position analysis is a subjective approach. Selection of the success criteria as well as their weighting and evaluation in the context of internal analysis take place according to a subjective viewpoint. The significance of the company analysis also depends to a large extent on the accessibility and quality of the information about customers, competitors, and market developments. The same goes for sources that permit assumptions about changes in the company environment and the resulting opportunities and threats.