Blockchain

Blockchains are currently trending and we can’t even imagine the current public debate without them. But what is so special about this technological phenomenon and its close relation to cryptocurrencies which offers a more far-reaching scope of application than Bitcoin?

Blockchains are used to verify transaction data. Its scope of application exceeds that of its predecessors, which initially helped to protect, certify, and distribute data. Furthermore, it is possible to use blockchain-orientated methods without any intermediary clearing houses. Payments, movement on the financial market, contracts, certifications, attestations, copyrights, patents, and registries can theoretically be administered without the need to involve banks, notaries, custodians, or any state institutions. The increasing interest in blockchain technology is not only evident in the banking sector, but also in the real estate, insurance, and health industries, which can also benefit from blockchain’s wide range of use. Supporters of this technological concept also predict its expansion to judicial systems, energy industries, and public administration.

In this article, we explain both how blockchains work and why online asset exchanges could become even quicker, more flexible, and more cost efficient than ever.

What is a blockchain?

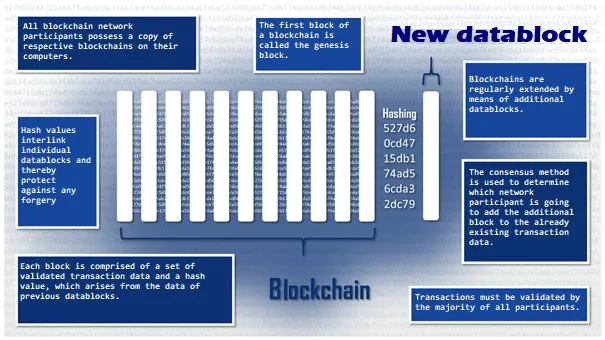

Blockchains are decentraliszed database systems in the form of a continuous expandable sequence of data blocks, which comprehensibly record internet transactions in chronological order. Picture the blocks of a blockchain as an unalterable sequence of data strings. This connection is made possible by means of cryptographic methods, which ensure that new data blocks come together in such a way that old blocks are neither substituted nor changed. As time goes by, a blockchain becomes increasingly longer and any modification of saved data is not possible.

Blockchain technology is primarily used in the documentation of transactions, which can be illustrated with the following example:

Paul has recently bought a new hat and would like to sell his old one through a small ads website. Hugo sees Paul’s ad on the internet. Both agree on the price of $£10. However, exchanging a hat for cash is rather problematic for both, as Paul is ready to send the hat only upon receiving money first. Hugo is not sure about the advance payment option, because there is always a danger that Paul will never send the hat. They therefore both necessitate an intermediary to step in.

To solve this problem, both Paul and Hugo could avail of an online payment service provider, which would then not only handle their transaction transparently and safely, but also document the whole procedure for a small charge. Such a string of events has become the standard operational procedure.

Blockchain technology is an alternative option for the so-called “Trusted Third Party” (TTP). As a result, transactions in blockchain networks are not verified by third parties, but rather by means of a jointly run, unforgeable accounting system called Distributed Ledger Technology (DLT).

Nowadays, blockchains are at our disposal in the same way as Bitcoin or Ethereum, all of which are used to assist online transactions, just like the one between Paul and Hugo. To avail of them, the only remaining step for our protagonists is to join the online community in question. Generally speaking, it suffices for Paul and Hugo to download and install appropriate client software, which would interlink their computers with a simple blockchain network.

The history of blockchains

Before the introduction of blockchain technology, the internet’s intermediating services were primarily based on the trust of both parties. If a client wants to acquire a product by an online vendor, both parties must form a relationship of trust with a centraliszed intermediary entity, namely an online payment service provider or a bank. The underlying assumption is that these will carry out transactions in the desired way.

The structure in question becomes a problematic concept when the intermediary entity takes advantage of its central position during the transactional procedure by turning it into a position of power, thereby only representing its own interests and attempting to seize full control. Such an incident occurred in 2010, when PayPal, the most common of all payment services, suspended the account of the whistle-blowing platform WikiLeaks.

Over the past years, in the attempt to turn the internet into a more democratic system, the cryptographic community has been consistently working on networks based on the peer-to-peer (P2P) principle, which would consequently facilitate transactions without the need for the presence of any intermediaries. BitTorrent, a collaborative communication protocol for P2P file sharing, makes it possible for such transactions to take place without any central server and enables a worldwide data exchange by means of anonymous usernames.

However, anonymity creates mistrust among those involved in online asset exchanges. To solve this problem, former professor of law and computer scientist Nick Szabo brought blockchain technology into the conversation in 1997. According to him, contracts are based not only on mutual trust between both parties involved in a transaction, but also on their acknowledgement of corresponding legal frameworks. Problems would nevertheless arise if the two people in question either did not share a mutual understanding, had diverging contracts, or if one of the members accused the other of a breach of contract. According to Szabo, future “Smart Contract” forms should be software-based and algorithmically determine whether the parties involved meet their contract requirements or breach any regulations.

This approach has been taken up by an unknown hacker going by the name of Satoshi Nakamoto, who combined the already established technologies such as P2P, hashing, and encryption to introduce a cryptographic method, with the aid of which he was able to interlink datasets in an irreversible and unforgeable way. The first application of blockchain technology – Bitcoin, a P2P cryptocurrency – comes from Nakatomo’s idea, which consequently resulted in other inventions such as Ethereum, Ripple, TradeBlock, and Dash.

How does blockchain technology work?

Blockchain technology is based on the concept of distributed ledgers, which require a computer network based on the P2P principle. Finding solutions to consensus building and validation therefore relies largely on cryptographic methods and approaches of game theory.

Distributed ledgers

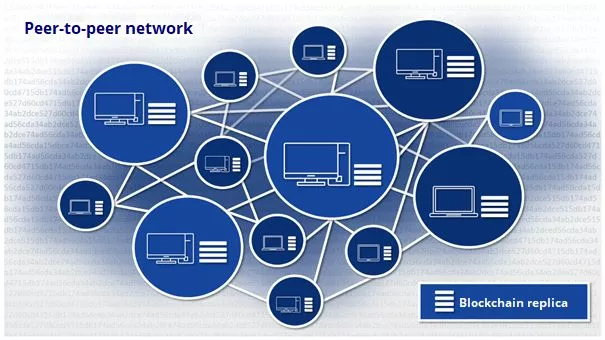

A distributed ledger is a public ledger conducted on a decentraliszed basis, the content of which (usually consisting of strings of data verifying account transactions) is created jointly with the aid of a computer network. A copy of the database is present in each of the network’s nodes.

To come back to our example, Hugo transfers the money for the hat to Paul by means of a blockchain. This transaction is then saved onto a distributed ledger and is consequently traceable for all parties involved from the moment the transfer has been activated.

Instead of dealing with real-life currencies such as the euro pound or the United States dollar, blockchain networks are primarily engaged in digital forms such as Bitcoin, Ethereum, Litecoin, or Dash. Distributed ledgers have been based on the concept of P2P networks, which enable communication between two equally-ranked computers. Changes to a database can only be made if respective networks reach a mutual consensus.

In P2P blockchain networks, digital assets are not transferred from A to B. Instead, the parties involved keep a copy of all transaction-related data in its anonymous form, from which it can be proven beyond doubt who the owner of respective digital assets is at any given time. In case of any changes made to the database, each copy is synchroniszed with the newest blockchain version on the level of all participating network nodes. The parties involved then interact with the blockchain by means of a client software, which holds control not only over the consensus method, but also over the replication of the database.

Changes to the database will only be accepted if the majority of all transaction members involved allow for them to take place.

If this happens, the freshly implemented blockchain is taken over by each participant. However, if the majority votes against the motion and declares that changes cannot be rightfully implemented (perhaps because there have been some inconsistencies in the former blockchain copies), then the blockchain is simply rejected. Furthermore, users wishing to implement changes to a blockchain must verify that they are authoriszed to make modifications to a database.

Peer-to-peer networks (P2P)

P2P networks are structures in which all of the interconnected nodes are equal to one another and are able to carry out identical functions. This therefore stands in contrast to client server models, in which central servers carry out administrative tasks for multiple clients. While Whilst client servers are usually managed by a commanding authority of some sort (i.e. a service provider), peer-to-peer networks do not necessitate any central administrative entities.

P2P connections, which constitute a crucial part of a blockchain set-up, make sure that respective participants have access to their co-created transaction database and are able to interact with it under a common set of rules. Although P2P is considered a fundamental part of the transparent data transaction administration in a blockchain network, it cannot avoid being associated with two challenging aspects, namely manipulation and inconsistency.

- Manipulation: If participants of a peer-to-peer network pursue diverging aims, some of them may attempt to manipulate the network’s functionality in their favorfavour.

- Data inconsistencies: It is necessary for those P2P networks without any central administrative entities to ensure that transactions are accurate, complete, and (in most cases) performed only once.

Coming back to the previous example of Hugo and Paul, upon settling the transaction with a digital equivalent of real-life currency worth £$10, blockchains must first make sure that the desired amount has actually been credited to Paul, and that this has only been done on a one-off basis (and not twice or perhaps even three times).

To avoid any data manipulation and guarantee consistency within the co-managed database, fully developed implementations of distributed ledgers such as Bitcoin or Ethereum rely both on costing methods and verification mechanisms. Blockchain technology therefore makes use of cryptographic hash functions during consensus building as well as when linking anonymiszed data blocks.

Hashing and anonymisation

Transaction data is saved in the form of data blocks in blockchain networks, which are later interlinked by means of hash values. Each block contains data relating to multiple transactions, which are anonymiszed. Each blockchain network participant can therefore take a closer look at the transactions, but not at their executors.

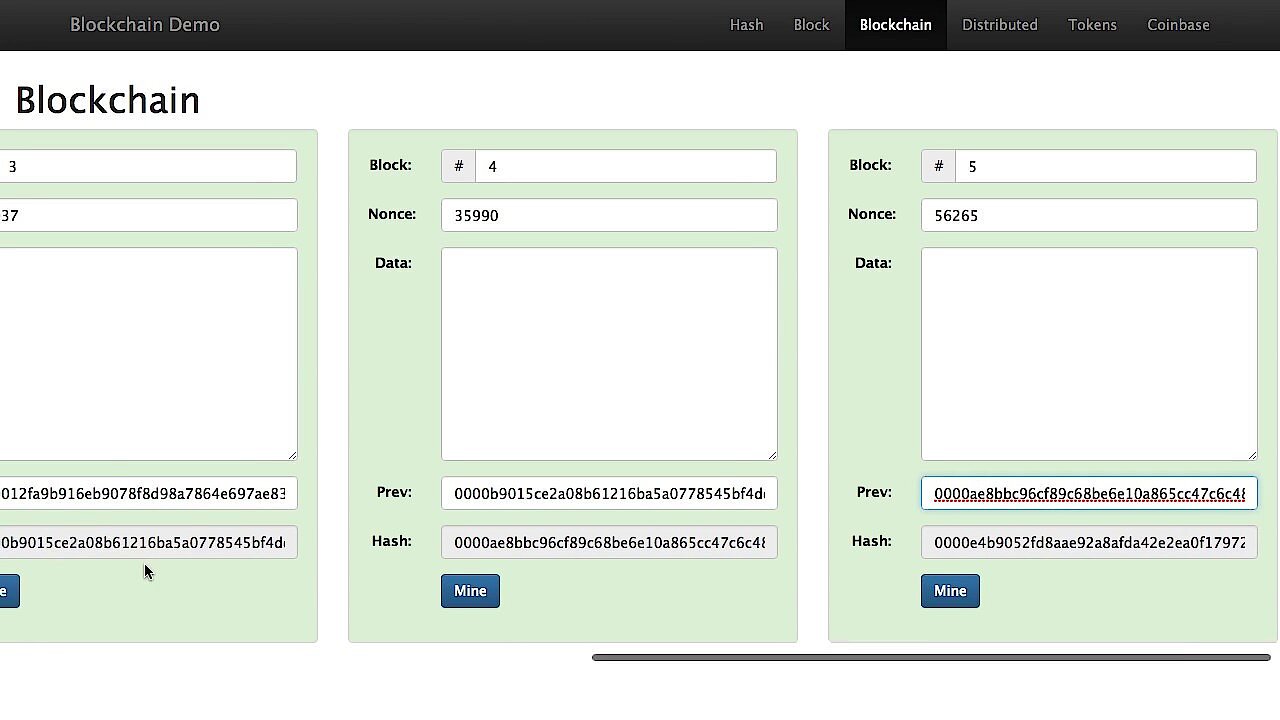

Linking individual data blocks is made possible thanks to hash values, which are inferred by blockchain software through hash functions from transaction-related data. This concept becomes clearer after watching Anders Brownworth’s free interactive tutorials entitled “How Blockchain Works” at blockchain.mit.edu.

This demo presents the manner in which transaction-related data is unalterably interlinked by means of hash functions. The process is all about simplifying the hashing mechanism, which is predominantly employed by Bitcoin.

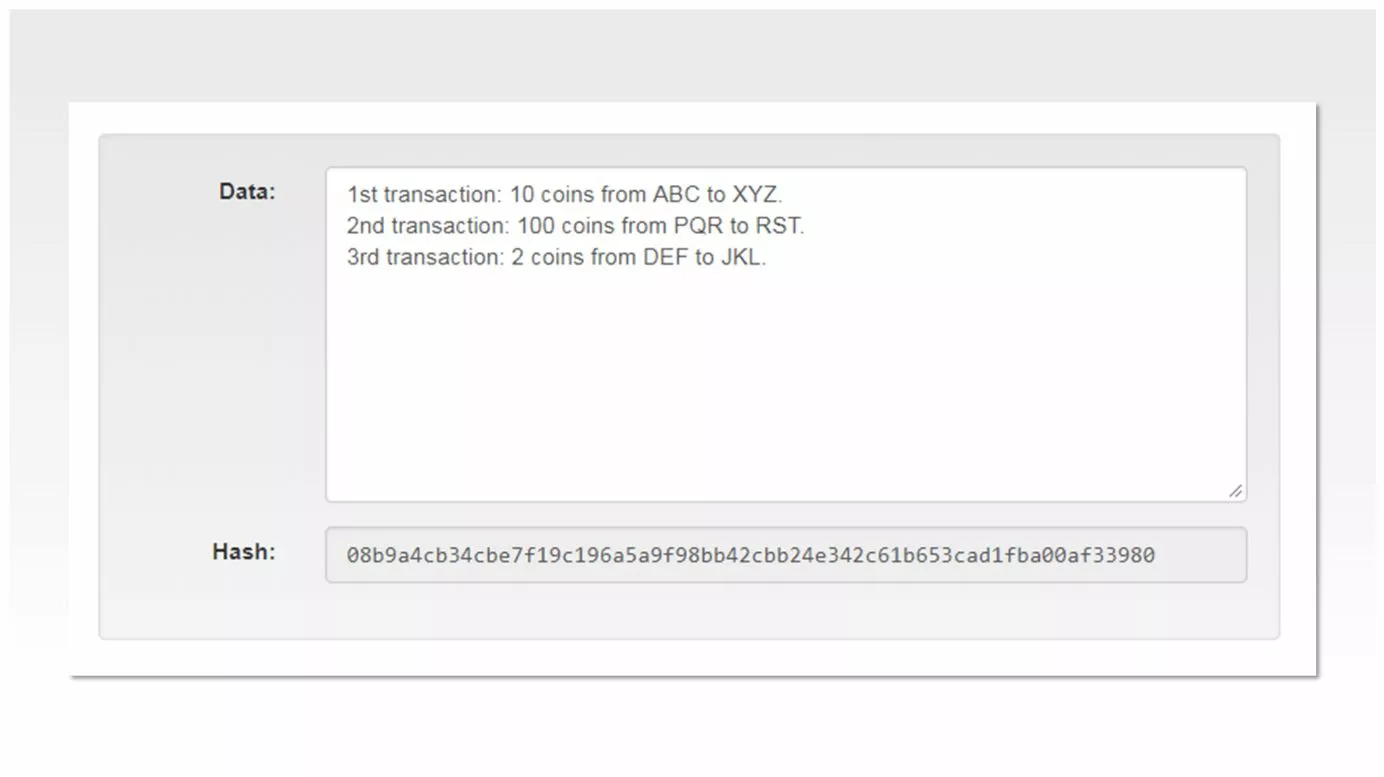

In the following example, we assume that a made-up blockchain is going to be extended by an additional block of data containing details on three different transactions.

1st transaction: 10 coins from ABC to XYZ

2nd transaction: 100 coins from PQR to RST

3rd transaction: 2 coins from DEF to JKL

From this data, a clearly defined hash value can be created by means of hash functions (also known as hash algorithms). For example, when using the hash algorithm SHA-256 (a variant of SHA-2 – Secure Hash Algorithm 2), what results is the following string of characters:

08b9a4cb34cbe7f19c196a5a9f98bb42cbb24e342c61b653cad1fba00af33980

Metaphorically speaking, hash-values are like the fingerprints of output data. A specific string of characters always results in the same hash value, provided that the same hash function is applied.

Hash values form a predefined string of characters made from letters and numbers, onto which hash functions are applied. Their length is always the same, regardless of the size of the saved volume of data. Additionally, they trace back to their respective hash algorithms, and in our example, the hash value consists of 256 characters.

The hash values of data blocks without any content are also of the same length.

At this point, we are not going to refer to any detailed hash value derivation. An in-depth analysis of the hash algorithm SHA-2 can be found on the official website of the University of Oldenburg. Furthermore, an introduction into the basic principles of cryptography can be found in our overview of encryption methods.

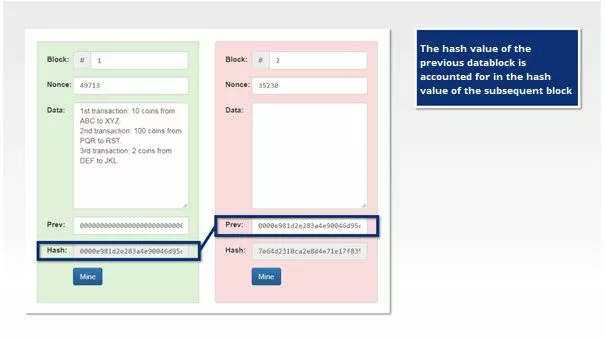

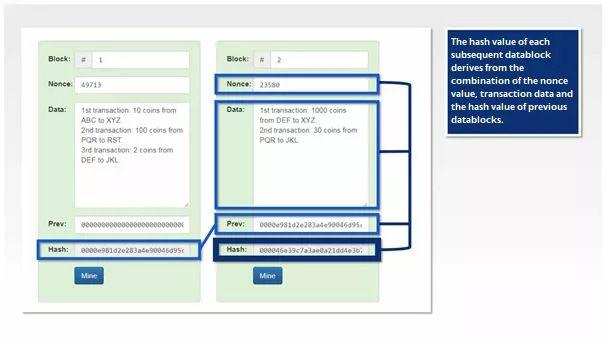

Contrary to how they were presented up until now, hash values used as part of blockchains are not merely derivatives of user data. In addition to transaction data saved in data blocks, the computation of hash values in new data blocks is made possible by means of both hash values of previous data blocks (Prev) and the so-called nonce values.

Those who wish to expand a blockchain by an additional data block must also know the hash value of its previous data block. The same principle applies to the computation of hash values of new blocks, which are then irreversibly connected to a blockchain. Here, nonces act as a kind of adjustment screw which allow the resulting hash values to be modified. This mechanism is used as part of the consensus method referred to as “proof-of-work.”

Consensus method and validation

Blockchains are collaboratively administered through peer-to-peer networks by equally measured data processors without any central supervisory authority. This requires a consensus method which not only controls the circumstances under which new data blocks are created but also keeps tabs on which participants are allowed to expand blockchains and when an expansion is actually allowed to take place. The most common of all consensus methods are the so-called proof-of-work and the proof-of-stake methods.

Proof-of-work is by far the most common of the two. It is famously implemented in hashcash – a procedure originally aiming to prevent spam e-mails. Nowadays, however, the internet community generally associates hashcash with cryptocurrencies such as Bitcoin, which applies the consensus method for the purpose of blockchain validation.

Every 10 minutes, Bitcoin blockchains are expanded by a new data block containing information on all transactions put into effect by members of respective networks in the past 10 minutes. The nodes that are going to be attached onto the existing Bitcoin data blocks are determined by means of a competitive peer-to-peer computer process called Bitcoin Mining. Blockchain networks therefore mainly rely on an economically-minded incentive scheme. All network participants are given the same mathematical task. Whoever solves it first is consequently allowed to generate the new data block, for which a reward awaits. In Bitcoin’s case, rewards are usually in the form of a predetermined amount of the digital cryptocurrency in question.

Hashcash, on the other hand, entails a mathematical task, in which a nonce value must be found in order for it to link up with user data and hash values of previous data blocks, subsequently generating a new hash value containing a set number of leading zeros.

Hashcash is therefore a CPU-based proof-of-work system. In other words, the more an individual network participant contributes towards the overall computing power, the higher the chances that they will find the desired nonce value first. In Bitcoin’s case, this often leads to vicious competition between respective users. To avoid a situation in which data blocks are generated at increasingly quick successions, thereby contributing to a constant increase in Bitcoins, networks regularly adjust the right nonce values to the difficulty of each task.

If two or more participants assess the right nonce value at the exact same time, the blockchain is extended only by the data block containing the higher amount of transactions. As a result, data blocks of other users expire and the transactions inscribed in them are recorded afresh in the pool of transactions that still need to be processed (provided that they are not already included in the newly created data blocks).

Linking by means of hash values makes sure that any attempt to manipulate respective blockchains is virtually impossible. Anyone who inserts a false blockchain copy, subsequently causing changes to one or more data blocks, makes the blockchain stand out due to its incompatible hash value. In this case, the falsifier would also recalculate the hash values of all subsequent data blocks by means of the falsified output value. Although this requires an immense computing power, the fraud would be noticed in the later stages when other network participants compare the falsified blockchain with their own copies. If more than a half of the participating users object to the false copy, it is automatically dismissed.

If a single participant or a group of allied users possesses more than 50% of all of the available network nodes, it is theoretically possible to take over the proof-of-work network solely by means of the computing power made available to all users. This is the so-called 51% attack. A blockchain network availing of consensus methods therefore becomes more secure as more participants join in.

An alternative method available within the framework of consensus building is the proof-of-stake method. Blockchain networks relying on it often determine which participants are allowed to generate data blocks by means of a weighted random sampling process. The weighting of each participant is assessed on the basis of the amount of time spent in the group or the amount of cryptocurrency owned.

Using both the proof-of-work and the proof-of-stake method at the same time is also possible.

Blockchain technology and its scope of application

Economists constantly watch the progress of blockchain technology with great interest. Basing solutions on blockchains lends itself particularly well to decentraliszed business procedures, as they can integrate more independent parties together (common in logistics or when manufacturing products). If tangible or intangible assets (like property rights) are passed through several hands, blockchains offer the chance to visibly record all processes and any status changes for all participants involved.

Furthermore, blockchain technology complies with the rapidly developing IoT sector. Internet of things is at a constant rise and so are the amount of devices that it brings together. In the future, data exchange and payments made in the IoT sector could be based on blockchains.

Blockchain technology is becoming an increasingly important factor in pilot projects. The trend is also moving closer towards private blockchains, which is proprietary software developed especially for internal business applications. Contrary to open source blockchains such as Ethereum or Bitcoin, private blockchains are only available to a selected group of individuals (workers, business partners, stakeholders etc.).

| Open source blockchains | Private blockchains | |

| Access | Open | Necessitates authoriszation |

| Speed | Slow | Quick |

| Identity | Anonymous/based on nicknames | Not in any way anonymous |

| Safety of use | Proof of work/stake | Predetermined admin |

Blockchain technology offers highly transparent automated procedures, which do not always meet with the approval of all group members. Only a minority of all businesses have full trust in the legal security of the technology. One of the most common problem areas of this sector is the possible loss of control over it, as well as deficient data protection or its unclear legal status.

Decentralisezed applications of blockchains can do without any supervisory authorities – this software brings many participants together and regulates any procedures related to their transactions or status changes without the need for any human intervention. From a legal point of view, it is worth questioning who should be made accountable for any potential mistakes or conflicts.

Open source blockchains are continuously presenting companies with data protection problems. Although transaction participants within a blockchain network are anonymous, information on the nature and scope of each transaction is accessible to all network participants. This is, however, something that companies sometimes keep confidential and it is for this reason that most of them check for admission restrictions within various blockchain technologies and their respective areas of use.

At the same time, open source blockchains used as part of consortia have also experienced a strong push forward. An example of this from the world of business is the so-called Hyperledger, which is an umbrella project of the Linux Foundation working together with SAP, Daimler, IBM, and Intel. Business applications based on Ethereum blockchains soon established what is nowadays known as the Enterprise Ethereum Alliance. In the insurance industry, leading companies such as Aegon, Allianz, or Munich Re federated into a blockchain consortium under the name of B3i standing for “Blockchain Insurance Industry Initiative.”

As a result, the research scope goes far beyond decentraliszed applications (called dApps). Blockchain technology offers valuable suggestions for decentraliszed organiszations on contracts (smart contracts) and organiszational forms (such as DAOs – decentraliszed autonomous organiszations). In theory, even entire companies can be managed by means of blockchains.

Smart contracts

Discontent caused by increasing digital centraliszation is one of the most significant reasons behind the rapid progress of blockchain technology. As a result, blockchains step in to replace centraliszed service providers, intermediaries, and supervisory authorities with their decentraliszed system.

Smart contracts are an example of such a decentraliszation procedure, as they enable the completion of sale contracts on the internet without the need to involve any banks, notaries, attorneys, or organiszed exchange markets. Instead, contracts are processed by blockchain networks reproduced during each corresponding transaction. Smart contracts can be used for the provision of the following services:

- Gaining access to rented property or rented vehicles by means of centraliszed key management (for the likes of cars, apartments, hotel rooms, and lockers)

- Proof of copyright, trademarks, domain rights, and licenses

- Documentation of data (commercial documents, GPS data, genomic data, medical records, production data)

- Settlement of trust agreements

- Notarial records without the need for notary’s presence (property ownership and usage rights)

- Usage of financial instruments such as commercial documents, bonds, and derivatives

- Instant awarding of loans, apartment rentals

The future potential of blockchain technology and its ability to revolutionisze contract-related issues depends, above all, on whether or not it will succeed in beating two significant hurdles. Firstly, what must be clarified is the confidential manner by means of which data found in blockchain networks is processed. Secondly, what is still missing is a scheme which would successfully prosecute any breaches of contract and enforce the settlement of missing due payments.

DAOs

More complex legal entities including entire organiszational structures are also modelled by means of various blockchains. These are termed as DAOs (decentraliszed autonomous organiszations) which stem from the concept “The DAO” – a crowdfunding project brought to life in May 2016 by an Ethereum-based blockchain. This blockchain represents a commercial model that aims to organisze non-profit companies in a decentraliszed and autonomous way.

With a financial capacity of over $168 million, “The DAO” is by far the biggest crowdfunding project of all time. Depending on the invested amount, each project member was given voting rights for issues pertaining to the awarding of contracts and investments based on smart contracts. Votes were cast electronically and processed by their corresponding blockchains. Members invested in Ether, but the project failed immediately, as hackers managed to lay their hands on around $50 million.

Bitnation

To become decentraliszed, some blockchain-based projects even tend to go one step further. Since 2015, Bitnation has become an internet nation widely available to all users without any borders or central governing bodies. All of its basic needs are market-oriented and met by private providers. In the long run, Bitcoin could establish itself as an alternative for what has traditionally been perceived as a nation.

Every Bitnation citizen has the right to vote, can bring in ideas, and promote them. Entry into the Bitcoin nation is not determined by one’s actual place of residence. This blockchain project not only provides passports, but also makes entries in the land register possible. It is predicted that marrying other Bitnation citizens will also be possible in the future. One can join different forms of government, each with their own laws. Operations are stored in encrypted text files and each citizen can be easily identified with an individual code. Contracts and other applications are regulated by means of smart contracts and the only available payment option are Bitcoins with blockchains as the governing control mechanisms.

Bitnation critics see its main fault in the purely economy-oriented nature of the project. In this virtual concept of a nation, law and order would have to be regulated by private entities. Environmental and social standards are not part of the discussion. On top of this, minorities find themselves at a serious disadvantage.

Companies currently availing of blockchain technology

Aside from the previously mentioned P2P currency systems, blockchain technology is put into practice very rarely. Currently, the majority of blockchain projects are still in their pilot phase or exist only as a concept which has not yet been put into practice. Nevertheless, new approaches to blockchain applications are constantly generated in almost every sector where economic aspects are the primary cause for concern.

Art and music industry

The potential of blockchain technology is evident especially in cases where music and art industries necessitate the implementation of copyrights. A blockchain network allowing artists both to register intellectual property (such as artworks or technological inventions) in a publicly accessible database and define its terms of use would simply make mediating authorities such as labels, agencies, and national copyright collectives obsolete.

In the past few years, the digitaliszation of music has injected a lot of tension. The Canadian start-up Peertracks is now looking to revolutionisze the music market by putting an end to the worldwide disarray caused by rights and licensing.

A piece of music, from the moment it is recorded up until it is sold, encompasses a complex network of participating entities. It is often the case that various individuals or stakeholders are in possession of rights to the same song. Compositors create music, to which authors write corresponding lyrics. Artists then interpret the song for themselves, while labels organisze the production line and take over any commercial responsibilities including marketing, promotion, and distribution. All these services are included within the copyrights and all participants receive proportionate amounts of revenue earned from the sale of CDs, downloads, or streams. Peertracks therefore intends to transparently disaggregate the entitling rights of each participating entity and process all payment methods by means of a single blockchain.

The Berlin-based start-up company Ascribe offers a similar concept, which addresses artists, photographers, and designers who would like to secure copyrights for their digital works. The platform gives creative individuals the chance to register compositions and award usage rights to their respective owners. With the aid of user history, it is possible to trace every step of a registered work and how it has been used in practice.

Media industry

When blockchain-oriented technologies establish themselves firmly within the media industry, companies actively using them will have to prepare for radical structural changes. This is primarily related to media corporations and their role as central content distributors.

What is worth taking into account here are the various blockchain-based platforms that create virtual environments for direct interactions between content creators and consumers. An example of this infrastructural phenomenon is Civil, which represents a decentraliszed marketplace for media content. From a list of journalistic productions, users of the platform can choose whatever they find interesting and pay corresponding text authors directly by means of a blockchain via so-called “CVL tokens” – the official cryptocurrency of the content hub.

Blockchains are also alternative forms of mediating authorities in the advertising industry, with online advertising seen as the sector with most potential for the implementation of blockchain technologies. Blockchain-based advertisement networks that enable bookings to be made directly with publishers are able to reduce the need of intermediaries and develop the advertisement market into a more transparent sector.

License trading between producers and their corresponding consumers is yet another area of application for blockchain technologies. There are already many companies availing of blockchain-based solutions in order to step up their contacts with TV stations, online portals, or providers of video-on-demand services.

Fashion and design industry

Blockchains and fashion? Not a problem. The industry concentrates predominantly on securing brand licenses. The first ever blockchain designed specifically for the fashion sector has been developed by Ethereum developer Fabian Vogelsteller and his company Lukso.

This blockchain has been first applied to a chip, which provides luxury products with a unique ID number. Products necessitating protection against falsifications are therefore registered within respective blockchains by means of such chips. Currently, the majority of luxury brands use QR codes for the identification process of their branded products.

Health sector

Each year, faulty administrative systems cause billions of dollars pounds to be lost in healthcare costs. Thousands of patients die as a result of such flawed systems. Blockchain technology could make favorablefavourable contributions facilitating the management of health records. By working together with the blockchain company Tierion, Philips was able to develop a concept aiding any future storage of patient-related data by means of blockchains. In Hyperledger’s case, the Hyperledger Healthcare Working Group (HLGC Working Group) is actively looking for solutions which enable patients to make their personal data available to third parties.

Beat, yet another start-up worth mentioning, has devoted its efforts to a much different aspect of the health industry, as it combines fragmented data from the sports and health sectors to facilitate performance measurements for athletes. Here, a blockchain is employed to act as a data pool.

Insurance industry

Axa, one of the biggest insurance companies on the market, has recently implemented a new policy entitled Fizzy, which is based on an Ethereum blockchain. Those who would like to avail of the cover offered by travel insurance (most cover against unexpected flight delays) do not have to do anything other than register themselves. The aim here is to form a more transparent picture of the contracts for date and claims processing by means of various blockchains.

Financing

In terms of financial services, intermediaries such as banks, external payment services, and stock markets react adequately to the threats of blockchain technology by adapting to the situation on the market. Continued research interest presents the sector in question with blockchain solutions, which enable making transactions in a more efficient manner and thereby reduce costs.

If there is one company which recogniszed the potential of blockchain technology for the financial market very early on, it’s certainly Visa. By means of the blockchain-based online platform Visa B2B Connect, the credit card company aims to make direct cross-border payments between companies safer, more efficient, and more transparent. Visa’s main market rival, MasterCard, also plans on using blockchain technology in the future. At the beginning of 2018, the company published a patent application for a blockchain, by means of which credit card identity data is sure to be stored safely. It is by using such forms of technology that MasterCard hopes to enhance the protection of customer data.

Fundraising

Fundraising for start-ups can also be processed by means of blockchains and cryptocurrencies. Such has been proven by Zoe Adamovicz and Marcin Rudolf and their newly founded start-up Neufund. This platform facilitates and speeds up the process of classic venture capital (VC) fundraising methods. Founders of start-ups, which are not based on blockchains or Bitcoin systems, are becoming increasingly interested in enabling financing by means of such technological variations.

Social projects

An example of a social project based on blockchain technology is that of the World Food Program (WFP) organisezed by the UN. The private blockchain generated by Datarella for the very purpose of this project aims to prevent any form of fraud and reduce the costs during the allocation of donations to refugees.

Each refugee is tagged and receives a limited budget for food. The identification of each one of them and their respective budget is made possible by means of a retinal scan in the shop area of the camp. The cryptocurrency used in the process is Ethereum, with each purchase free of any extra charge and directed through blockchain-based accounts.

Possible challenges when implementing blockchain-based technology

In the past, technologies based on blockchains have been able to successfully decentralisze various systems. As a result, they not only help to break up powerful concerns but also shape internet transactions in a more transparent manner. The downside to such distributed systems is their redundancy. In a blockchain network, each node is supplied with a copy of respective transaction histories. In principle, each person participating in any given consensus method such as the proof-of-work performs the same calculation. In addition, blockchain applications generate large amounts of data, which must be downloaded by each user as part of the validation process. Reducing the enormous energy consumption levels and other similar resources by means of blockchain applications is therefore seen as one of the key challenges.

The increasing speed of transactions is also considered a rather challenging aspect. Bitcoin – the blockchain solution with the highest level of market capitaliszation and transactions – processes seven of them per second (on average). Such a rate is influenced by the computationally intensive consensus method. However, this value is no match for the processing speed of leading payment service providers. In the same time span, PayPal alone processes around 450 transactions, while Visa manages a staggering 56,000. The fastest online payment system – Alipay, owned by the Chinese Alibaba Group – processes up to 256,000 transactions per second. However, Lighting Network has already drafted a method, with the aid of which Bitcoin transactions can be accelerated. Raiden Network offers a similar solution for Ethereum.

Blockchains are managed without any trusted third party (TTP). Theoretically speaking, their security is ensured by the decentraliszed transaction history management. This is effective only in large blockchain networks, because stakeholder groups owning more than 50 percent of all network nodes are easily able to nullify the collective validation and introduce an alternative transaction history. A potential risk of manipulation arises even in cases where the majority of users of an international blockchain network come from the same country.

Until the end of 2017, the computing capacity of Bitcoin blockchains was generated by Bitcoin miners, two-thirds of which came from China. To put an end to the immense power consumption, the Chinese government forcefully withdrew from the Bitcoin market on a nationwide level in January 2018.

Data protection requirements also pose various challenges for blockchain developers. Public blockchains especially lack the correct solutions for the secure processing of transaction data. Although they anonymisze transaction participants, public blockchains make every other transaction detail available to all network participants.

Summary: Blockchains will continue succeeding, but how?

One thing is certain – blockchains will succeed. They have already shown what they are capable of. While Whilst public blockchains such as those using cryptocurrencies like Bitcoin focus primarily on private users, most companies relying on new technology initially place their bets on private blockchain solutions.

Future success of blockchain structures and their struggle against centraliszed systems depends largely on the research community and its ability to overcome hurdles related to data security and processing costs. Nevertheless, the potential to make transactions faster, more transparent, and more cost-effective (for virtually any industry whatsoever) is evident in both of the use cases mentioned in this article.